If you work from home, you might be eligible for a home office deduction on your taxes. The IRS outlines guidelines on how to claim this deduction using Form 8829. This form is particularly useful for self-employed individuals seeking more itemized deductions than the standard simplified method offers. Here’s a detailed guide on accurately completing Form 8829 to calculate your home office deduction.

- Determine the Business Percentage: Measure the square footage of your home office and divide it by the total square footage of your home to determine the business percentage.

- Calculate Direct and Indirect Expenses: Identify direct expenses like repairs and maintenance and calculate indirect expenses such as utilities and mortgage interest on a prorated basis based on the business percentage.

- Fill out Schedule C: Report your business income and expenses using Schedule C, entering allowable office expenses from Form 8829.

- Determine Business Deductions: Multiply total allowable expenses on Form 8829 by the business percentage to find the deductible portion.

- Transfer the Deduction Amount: Enter the deductible portion on your personal tax return. If using the simplified method, input the square footage of your office directly on Schedule C.

Can Your Home Office Qualify for Deductions?

To qualify for a home office deduction, your workspace must be regularly and exclusively used for your business. It should be your principal place of business, a location for meeting clients, or a separate structure not attached to your home.

Measuring Your Office Square Footage:

Accurately measuring your office space is crucial. Follow these steps:

- Measure the total square footage of your home, including all areas.

- Measure your dedicated home office, calculating the square footage by multiplying length and width.

- Calculate the business area percentage by dividing your home office’s square footage by the total square footage of your home.

Determine Your Allowable Deductions:

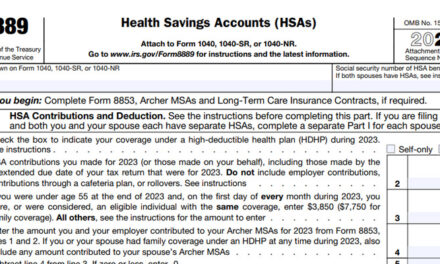

When completing Form 8829, consider deductions like mortgage interest, real estate taxes, home insurance, rent, and repairs and maintenance. Keep records and receipts for these expenses to support your deductions.

Depreciate Your Home from Your Office:

To claim the home office deduction, depreciate your home based on adjusted basis or fair market value. Consult with a tax professional to ensure accurate calculations.

Find the Carryover of Unallowed Expenses:

If your business expenses exceed the allowable deduction, report the excess on Form 8829. Calculate and report the carryover of unallowed expenses for future tax years. Consult with a tax professional for a comprehensive understanding.

Expenses for Business Use on Form 8829

If you run a commercial enterprise from your house, claiming expenses for enterprise use on your tax return can be a treasured gain. Form 8829 is a vital tool in this process, allowing you to deduct valid costs related to your house workplace. In this guide, we’ll walk you via the right completion of Form 8829, emphasizing allowable deductions, barriers, concerns while moving, and the recovery length.

Legitimate Business Expenses for Form 8829

For self-employed individuals using part of their domestic for commercial enterprise, Form 8829 permits the deduction of valid business charges. These encompass deductible mortgage interest, real property taxes, home insurance, lease, repairs and renovation, and utilities. Calculating the percentage of your house used for enterprise is crucial to claim those fees accurately.

Deduction Limitations to Home Office Tax Write-offs

Understanding deduction limitations is essential while claiming the business use of your own home. Most domestic office prices are constrained to the share of your property used for enterprise functions. Common deductions, inclusive of hire, deductible loan hobby, utilities, insurance, and home depreciation, can be claimed using either the location method or the quantity of rooms technique. Detailed data and receipts are important for assisting those deductions.

Accounting for Expenses When Moving on Form 8829

For contributors of the defense force on active obligation who pass for the duration of the yr, knowledge the effect on Form 8829 deductions is essential. Moving costs may be claimed if unique criteria are met. Gathering evidence for both vintage and new locations, inclusive of receipts and invoices, is crucial. Consulting with a licensed tax expert guarantees accurate documentation and steering tailor-made to your state of affairs.

“Other Expenses” on Form 8829 Lets You Include Indirect Expenses

Apart from the home workplace deduction, there are additional expenses categorized as "other prices" on Form 8829. These encompass prices at once related to commercial enterprise use however no longer protected by using the house workplace deduction, which include real property taxes, deductible mortgage hobby, and casualty losses. Reporting these fees on Line 22 of Form 8829 is essential for accurate deduction, and expert steerage is recommended to make sure right documentation.

Form 8829’s Recovery Period

Understanding the recovery period on Form 8829 is vital for depreciating belongings used for commercial enterprise functions. The recuperation duration varies based totally at the asset type, with residential real estate utilized in a domestic office typically having a 39-yr restoration length. This dictates the timeline over which depreciation deductions can be claimed. Professional advice guarantees correct calculations and enables maximize allowable deductions.

Sources

“IRS Form 8829 walkthrough (Expenses for Business Use of Your Home)” – Teach Me! Personal Finance

Conclusion:

Mastering Form 8829 is vital for business owners seeking to optimize deductions related to their home office. By accurately reporting legitimate expenses, understanding deduction limitations, considering moving implications, including indirect expenses, and comprehending the recovery period, you can navigate the tax landscape with confidence and minimize your overall tax liability. Always consult with a licensed tax professional for personalized guidance tailored to your specific circumstances.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.