Owning a home isn’t always just about having a place to name your personal—it can also be a treasured asset come tax season. The government offers several tax breaks designed to promote homeownership and power conservation, and taking gain of these deductions and credit can result in good sized savings and potentially a healthy tax refund.

Here are a few key tax breaks to be had to owners:

Mortgage Interest and Points Deduction

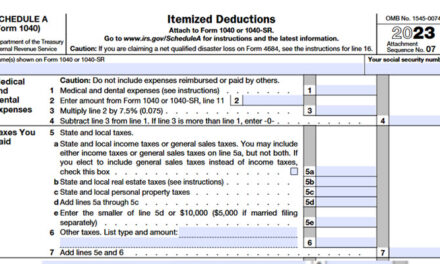

The interest and points paid in your mortgage are typically tax-deductible. This applies to the hobby at the authentic loan for getting your home or refinancing for home enhancements. However, in case you refinanced your home to repay non-domestic-related fees, the hobby on the more loan quantity isn’t always deductible.

Points paid whilst you originated the mortgage also can be deductible within the first 12 months. For factors on refinance loans and domestic fairness lines of credit score, the deduction is spread out over the existence of the mortgage. Your mortgage organization must offer you with a tax shape detailing your paid interest and factors for the year.

For more records, consult with IRS Publication 936 (Home Mortgage Interest Deduction).

Deduct Casualty Losses Affecting Your Home

If you experienced good sized losses due to robbery, vandalism, or natural disasters and needed to pay for repairs out-of-pocket, you will be eligible to deduct these losses to your tax go back. This can consist of fees for water damage, roof repairs, tree elimination, and other associated prices.

For more facts, consult IRS Publication 547 (Casualties, Disasters, and Thefts).

Energy-Efficient Home Improvements

Investing in energy-green improvements for your home can qualify you for tax credits that immediately reduce your tax liability. Eligible improvements include insulation, windows, doors, furnaces, warmness pumps, and roofing that meet Energy Star or EPA standards. These tax credits are especially beneficial as they may be implemented immediately to lower your tax stability, in contrast to deductions which handiest lessen taxable profits.

For more facts, visit the Energy Star website or refer to the IRS FAQ’s approximately Energy Incentives for Residential Property.

Deduct Property Taxes

The assets taxes you pay to nearby and state governments can be deducted in your tax return, in conjunction with sales tax. However, the federal deduction for state and neighborhood taxes is limited to $10,000 (or $5,000 for married couples submitting one by one).

For extra info, see IRS Publication 503 (Tax Information for Homeowners).

In conclusion

It is essential to make the most of your tax options as a homeowner. Consulting a tax professional can assist make certain you take complete advantage of each available tax smash when filing your subsequent tax go back.