Understanding the Tax Implications of Private School Tuition and Other Education Expenses

When navigating the complexities of tax deductions for education charges, it’s important to understand the nuances of federal tax legal guidelines, in particular concerning K-12 education. Here, we delve into the different factors that impact the tax deductibility of personal school lessons and explore potential tax blessings available at both federal and state levels.

Federal Tax Implications

The Internal Revenue Service (IRS) gives tax breaks for certified education charges, yet private faculty training generally isn’t always tax deductible unless the scholar has special desires necessitating personal training. Expenses like enrollment charges and extracurricular sports are also excluded from qualified education expenses. Public faculty attendance, being free, doesn’t entail tax benefits.

Additionally, earnings limits determine eligibility for tax breaks. For example, the American Opportunity Credit has profits phase-out limits that might disqualify better-earnings families.

State-Specific Programs

While federal laws govern maximum tax implications, certain states offer their very own tax alleviation programs for K-12 private college prices. For example, South Carolina presents tax credits for qualifying private school lessons. State-particular rules ought to be consulted to examine eligibility for such packages.

Types of Tuition That Qualify

The IRS usually disallows tax deductions for non-public education lessons, along with private college lessons and extracurricular fees. However, exceptions exist, extensively for special wishes college students whose tuition charges can be tax-deductible. This popularity by the federal authorities acknowledges the extended charges associated with special schooling.

College Tuition Deductions

Unlike private K-12 training, college tuition enjoys diverse tax advantages together with the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC). These deductions purpose to alleviate the economic burden of publish-secondary training.

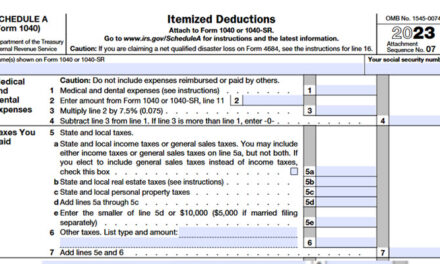

Understanding Qualified Education Expenses

IRS recommendations dictate what qualifies as a deductible training cost. These encompass training and fees, books, materials, and different important expenses for attending eligible instructional establishments. Room and board charges, along side non-instructional sports, commonly don’t qualify.

Tax Benefits for Education Expenses

Federal tax blessings which include the American Opportunity Tax Credit (AOTC) purpose to alleviate the charges of schooling. Eligibility standards include enrollment fame and earnings thresholds. Qualified education prices for these benefits encompass lessons expenses and required course substances.

Qualifying Student Requirements

Students need to be enrolled in eligible academic applications, pursuing recognized credentials, to qualify for tax benefits. Additionally, taxpayers must meet specific conditions to claim deductions for qualified schooling charges.

Eligibility and Income Limits

Eligibility for tax benefits hinges on assembly requirements and earnings limits. These benefits aim to relieve education fees thru deductions or credits for eligible costs. Income thresholds vary primarily based on submitting popularity and the gain being claimed.

Exploring Canadian Programs

In Canada, the federal authorities gives numerous own family tax advantages associated with education. These programs provide tax financial savings through credit, deductions, and grants, assisting households in coping with training prices.

Navigating schooling-related tax advantages calls for a comprehensive know-how of federal and kingdom legal guidelines, eligibility standards, and allowable deductions. Consultation with tax specialists is counseled to maximize to be had advantages even as ensuring compliance with rules.