What Is Taxable Income? A Comprehensive Guide

When it involves know-how taxes, one of the first standards you’ll come across is taxable income. It forms the foundation of ways a lot you owe the IRS every yr. While it may sound honest, taxable earnings includes various nuances which can considerably impact your financial planning and tax filing technique. Let’s break it down into simple, easy sections to make it simpler to grasp.

Defining Income: The Basics

Income, in its simplest terms, is money, goods, or other economic benefits you receive. It can be categorized as either:

- Active Income: Earnings from labor, such as wages, salaries, or self-employment income.

- Passive Income: Earnings from investments, rentals, dividends, or other sources that don’t require active labor.

While most income is taxable, some forms of income are exempt from taxes under specific conditions. Let’s explore taxable and nontaxable income and how they fit into your financial picture.

What Is Taxable Income?

Taxable earnings is the part of your total profits this is situation to taxes after deductions and exemptions. It’s calculated by subtracting allowable deductions out of your gross earnings. The IRS defines earnings extensively, this means that it is able to consist of cash, assets, or services you receive.

Your taxable profits is generally less than your Adjusted Gross Income (AGI) due to the fact deductions (standard or itemized) lessen it. Here’s a breakdown of the commonplace forms of taxable income:

1. Employment Income

- Salaries and wages

- Bonuses and tips

- Fees from employers

2. Self-Employment and Side Jobs Income

- Freelance or gig work earnings

- Rental income

- Royalties

- Value from bartering (exchanging goods/services without cash)

3. Business Income

For business owners, taxable income equals total revenue minus business expenses and deductions. Partnerships pass their income, deductions, and losses directly to the partners for reporting.

4. Investment Income

- Capital gains

- Dividends

- Interest earned

- Cryptocurrency or digital asset gains

5. Non-Business Benefits

- Unemployment benefits

- Social Security income (partially taxable in some cases)

- Retirement plan distributions, pensions, or annuities

6. Miscellaneous Income

- Gambling winnings

- Prizes and awards

- Alimony payments (for divorces finalized before 2019)

- Debt cancellation

What Is Nontaxable Income?

Not all income you receive is taxable. The IRS classifies certain types of income as nontaxable. However, these exemptions often come with conditions.

Examples of Nontaxable Income

- Financial Gifts: You can receive financial gifts up to the annual federal tax limit ($19,000 for 2025).

- Inheritances: Federal law exempts inheritances from taxes, but state laws may vary.

- Disability Benefits: Workers’ compensation, Supplemental Security Income (SSI), and veterans’ benefits are nontaxable.

- Roth Account Distributions: If your Roth account is over five years old and you’re at least 59 ½ years old, withdrawals are tax-free.

- Alimony and Child Support Payments: Alimony from post-2019 divorce agreements and all child support payments are nontaxable.

- Long-Term Care Insurance: Payments from long-term care insurance policies are exempt from taxes.

Deductions and Exemptions: Reducing Your Taxable Income

Standard vs. Itemized Deductions

Standard vs. Itemized Deductions

One of the most effective ways to lower your taxable income is by claiming deductions. The two main types are:

- Standard Deduction: A fixed amount based on your filing status:

- Single taxpayers: $15,000 (2025)

- Married couples filing jointly: $30,000 (2025)

- Heads of household: $22,500 (2025)

- Itemized Deductions: Includes specific expenses such as:

- Mortgage interest

- Medical and dental expenses

- Charitable donations

- Casualty and theft losses

Above-the-Line Adjustments

These are deductions you can claim without itemizing:

- Retirement plan contributions

- Student loan interest

- Health savings account (HSA) contributions

- Educator expenses

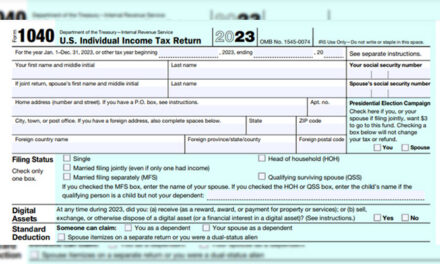

Calculating Your Taxable Income: A Step-by-Step Guide

Step 1: Determine Your Filing Status

Your filing status (e.g., single, married filing jointly, head of household) affects your tax brackets and standard deduction.

Step 2: Gather All Income Documents

Collect forms like W-2 (employment income), 1099-NEC (contractor income), 1099-B (capital gains), and others.

Step 3: Calculate Your Adjusted Gross Income (AGI)

Subtract above-the-line adjustments from your gross income to determine your AGI.

Step 4: Apply Deductions

Choose between the standard deduction or itemized deductions to reduce your AGI further.

Step 5: Compute Your Taxable Income

After deductions, the remaining amount is your taxable income.

Common Mistakes When Reporting Taxable Income

1. Misreporting Income

Overlooking smaller income sources, such as freelance gigs or dividends, can lead to penalties. Ensure all income is accounted for.

2. Confusing Taxable and Nontaxable Income

Not all income is treated the same. For example, gifts are nontaxable, but interest earned from a gift account is taxable.

3. Missing Adjustments

Above-the-line deductions like retirement contributions can significantly lower taxable income but are often missed.

4. Neglecting Records

Keep documentation for all income sources and deductions to avoid discrepancies and penalties during an IRS audit.

Final Thoughts

Understanding taxable income is essential for accurate tax submitting and effective financial planning. By understanding what qualifies as taxable and nontaxable profits, leveraging deductions, and warding off commonplace errors, you can optimize your tax liability and avoid headaches with the IRS. If you discover the technique overwhelming, recollect consulting a tax professional for steerage.

Tax season doesn’t must be annoying. With a clear understanding of taxable income, you may record optimistically and probably store cash inside the technique.