Navigating the financial challenges of a divorce can be overwhelming, but there might be some relief through potential tax deductions, particularly with alimony payments. This article aims to shed light on the types of alimony payments eligible for tax deduction, the claiming process, and crucial considerations.

Unlocking Tax Savings: Alimony Deductions Explained

For those recently divorced, a silver lining may come in the form of deducting alimony payments from their taxes. To qualify, these payments must be in cash, part of a legal agreement or court order, and the recipient cannot file taxes jointly with the payer. While there are additional requirements, these are the fundamentals for claiming an alimony deduction.

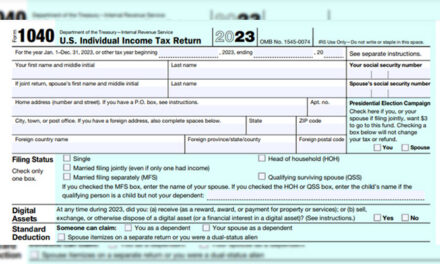

The claiming process involves providing the recipient’s Social Security number, and both parties should maintain detailed records of all payments made. On tax returns, report the payments as “alimony” on Form 1040 Schedule 1. This amount is then deducted from the gross income when filing taxes.

While alimony deductions can alleviate financial strain post-divorce, it’s crucial to note that it may not apply to everyone. Consulting with a tax professional before making any claims is advisable.

Navigating Alimony Deductions: What You Need to Know

Understanding the criteria for claiming a deduction is crucial. Payments must be in cash, part of a legally binding agreement, and the recipient cannot file taxes jointly with the payer. Detailed record-keeping throughout the year, along with providing the ex-spouse’s Social Security number during tax filing, enhances the likelihood of benefiting from this deduction.

If uncertainties arise regarding qualification, seeking guidance from a tax professional is wise. The potential savings from claiming an alimony deduction can significantly impact annual tax burdens.

Meeting IRS Requirements: Crafting Your Agreement

Ensuring your separation agreement or divorce decree aligns with IRS standards is essential for deducting alimony payments. Key considerations include clearly stating that payments are for alimony, ensuring periodic payments without a set end date, and specifying that the payments cease upon the recipient spouse’s death.

For those unsure about meeting these criteria, consulting a tax professional can provide clarity. Accurate documentation and proper tax filing can lead to substantial savings.

Social Security and Alimony: Untangling the Connection

Navigating Social Security treatment of alimony payments requires understanding how the Social Security Administration views them. While alimony may count as income for calculating Social Security benefits, any taxes paid on alimony are non-deductible from Social Security benefit amounts.

For individuals receiving spousal support from a Social Security beneficiary, the alimony payments don’t contribute to the beneficiary’s income calculations.

Seeking advice from tax experts or financial advisors ensures optimal understanding of alimony and Social Security benefits, maximizing benefits while adhering to regulations.