Navigating the intricacies of tax-related matters, especially in the realm of health insurance, can often seem like a daunting task. One critical document that demands attention is IRS Form 8962, more commonly recognized as the Premium Tax Credit form. This form is the linchpin in reconciling the Premium Tax Credit with any advance credit payments you might have received.

The Premium Tax Credit serves as a lifeline, a governmental subsidy crafted to assist eligible individuals and families in making health insurance premiums more manageable. When opting for a Qualified Health Plan through the Health Insurance Marketplace, individuals have the option of receiving advance credit payments, offering a helping hand in offsetting those monthly insurance premiums.

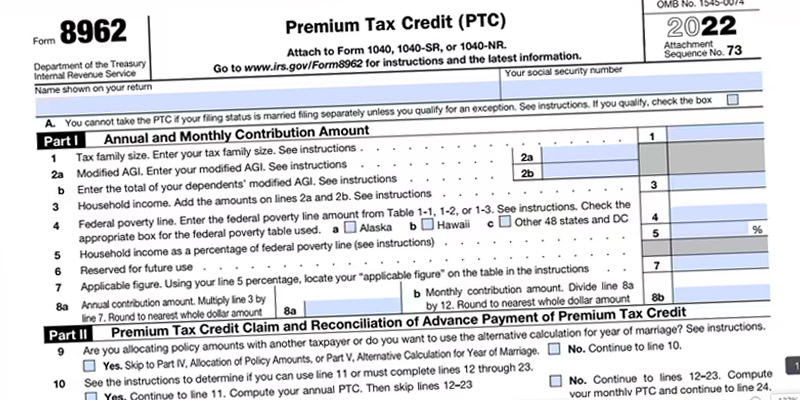

Form 8962 steps into the spotlight to ensure that these advance credit payments align seamlessly with the actual Premium Tax Credit an individual qualifies for, contingent upon factors such as household income and family size. Its primary purpose is to verify whether the advance payments were accurate or if there’s a need to reimburse any excess amounts. Worth noting is that if you possess a health care policy from a source outside the marketplace and received a 1095-B form, Form 8962 does not apply.

Successfully completing Form 8962 requires essential information from your health care tax form 1095-A, a document obtained from the health exchange that meticulously outlines health insurance coverage and the advance credit payments received. Additionally, precision in inputting details such as household income and family size is paramount.

At the heart of this process is the Advance Premium Tax Credit (APTC), a pivotal component of Form 8962. This federal tax credit serves to lower monthly health insurance premiums, functioning as a government subsidy. The APTC amount is contingent on estimated yearly income and personal exemptions claimed. To steer clear of discrepancies in APTC amounts, promptly reporting changes in income or exemptions to the Health Insurance Marketplace is imperative. Form 8962 steps into play during the reconciliation phase, determining whether the correct APTC was received and if there are grounds for repayment or eligibility for a refund.

Let’s break down the steps for successfully completing Form 8962:

- Enter your personal details at the top of the form.

- Calculate the Premium Tax Credit (PTC) in Part I, utilizing data from Form 1095-A.

- Reconcile APTC received with the calculated PTC in Part II, thereby determining any repayments or refunds.

- For those who are married and filing jointly, complete Part III, allocating PTC, exemptions, and shared policy details.

- Sign and date the form, ensuring it is attached to your tax return.

Form 8962 is indispensable for individuals seeking to claim the Premium Tax Credit or those who have received Advance Premium Tax Credit payments. It acts as a safeguard, assuring accuracy in APTC and PTC calculations, potentially paving the way for refunds or repayments. The form is intricately linked to the Affordable Care Act and the Health Insurance Marketplace, requiring precise information from Form 1095-A for a seamless completion process.

IRS Form 8962 Instructional Guide

Access Form 8962 PDF – IRS Official Document

Your articles are very helpful to me. May I request more information?

You’ve the most impressive websites.

How can I find out more about it?

Please provide me with more details on the topic

Your articles are extremely helpful to me. May I ask for more information?

Thanks for posting. I really enjoyed reading it, especially because it addressed my problem. It helped me a lot and I hope it will help others too.

Great beat ! I would like to apprentice while you amend your web site, how could i subscribe for a blog site? The account helped me a acceptable deal. I had been a little bit acquainted of this your broadcast provided bright clear concept