Ever heard of envisioned taxes however felt beaten by using the manner? Form 1040-ES is your key to navigating this device. This weblog cuts thru the jargon and equips you with the know-how to deal with your anticipated taxes like a seasoned.

What is Form 1040-ES for?

Form 1040-ES is all about paying estimated taxes at some stage in the yr. This applies to profits that doesn’t have taxes automatically withheld, which include:

- Income from self-employment

- Interest earnings

- Dividend earnings

- Rental profits

- Alimony payments

Benefits of Using Form 1040-ES:

- Avoid Penalties: By making anticipated tax bills, you keep away from capability consequences from the IRS for underpayment of taxes.

- Peace of Mind: Spreading out your tax burden with expected bills prevents a big tax bill on the stop of the year.

- Accuracy: Estimated tax bills assist ensure you’re paying the precise quantity of taxes at some point of the 12 months.

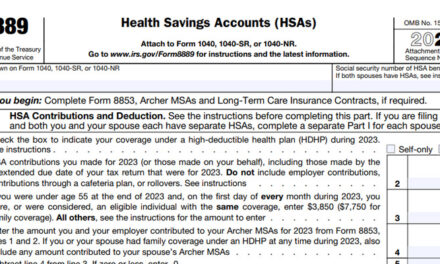

Filling Out Form 1040-ES:

The form itself is fairly straightforward. Here’s a quick rundown:

- Estimate Your Tax Liability: Use your previous 12 months’s tax return or consult a tax professional to estimate your contemporary 12 months’s tax burden.

- Figure Out Your Payments: Divide your expected tax legal responsibility via 4 to determine your quarterly fee quantity.

- Complete the Form: Fill on your non-public statistics, predicted tax quantity, and preferred fee method (electronic or paper check).

Important Details:

- Who Needs to File: Generally, you want to report Form 1040-ES in case you anticipate to owe at the least $1,000 in taxes after withholding and credit. There are exceptions, so check the IRS website for specifics.

- The 90% Rule: This rule permits you to base your estimated taxes on 90% of your modern-day year’s tax liability or one hundred% of your prior yr’s tax legal responsibility (whichever is decrease).

- Penalties for Not Paying: The IRS may additionally charge you an underpayment penalty in case your predicted tax payments fall brief of what you honestly owe.

Can I Print Form 1040-ES?

Absolutely! You can download and print the form directly from the IRS website form section.

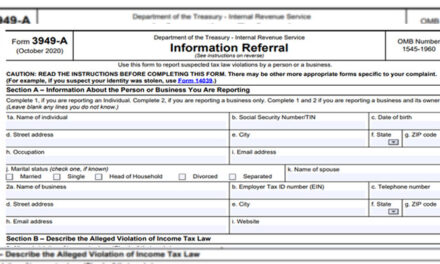

What Happens if I Don’t Pay 1040-ES?

While not submitting is not ideal, the IRS may also impose underpayment consequences. It’s pleasant to seek advice from a tax professional if you haven’t filed and owe taxes.

IRS Links for more Information

- IRS (.gov) Form 1040-ES: This is the official IRS website where you can download the latest version of Form 1040-ES: https://www.irs.gov/forms-pubs/about-form-1040-es

- IRS Estimated Tax Payments: This IRS webpage provides more in-depth information on estimated taxes, including who needs to file, payment deadlines, and penalty details: https://www.irs.gov/businesses/small-businesses-self-employed/estimated-taxes

- Publication 505 (Tax Guide for Businesses): While geared towards businesses, Publication 505 also covers estimated tax basics for individuals: https://www.irs.gov/publications/p505

Remember, this blog is for informational purposes handiest. For specific tax recommendation, seek advice from a qualified tax expert.

Trackbacks/Pingbacks