This article explores the de minimis safe harbor election, a provision that simplifies tax treatment for small-dollar enterprise expenses. It explains the eligibility standards, value thresholds, and implications of making the election, permitting organizations to make knowledgeable choices approximately their tax submitting techniques.

Key Points:

- What it’s far: An optional approach for small companies to right away deduct certain small-greenback expenditures on tangible property as commercial enterprise charges inside the 12 months they’re incurred.

- Benefits: Simplifies tax accounting, reduces compliance costs, and lowers administrative burdens.

Eligibility: Open to businesses with a relevant financial declaration or average annual gross receipts of $25 million or less for the beyond three years. - Cost Threshold: $2,500 or much less in line with item/bill (improved from $500 for tax years before 2016).

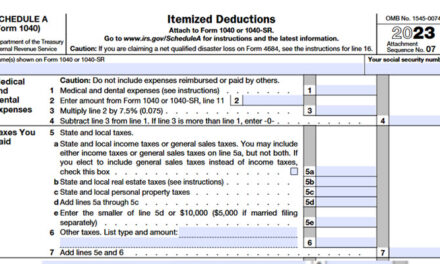

Election Process: Requires attaching an announcement to the timely filed federal tax return and retaining a written accounting policy. - Qualifying Expenditures: Materials, resources, private property, homes, improvements, and other tangible assets used in business operations (except for land and intangible belongings).

- Implications: Excludes small-greenback costs from capitalization policies, allowing immediate deductions for qualifying expenses.

Understanding the De Minimis Safe Harbor Election

The de minimis safe harbor election streamlines tax filing for small organizations via providing an alternative technique to dealing with positive costs. By electing this approach, organizations can deduct qualifying small-dollar fees on tangible belongings inside the year they are incurred, rather than capitalizing and depreciating them over the years. This can drastically reduce administrative burdens and simplify document-retaining for businesses that regularly incur small expenses on numerous tangible belongings.

Eligibility and Cost Thresholds

To be eligible for the de minimis safe harbor election, organizations must meet unique standards. They have to either have an applicable financial assertion or have common annual gross receipts of $25 million or less for the previous 3 tax years. Additionally, the value of each character object of belongings cannot exceed $2,500 (or $500 for tax years before 2016) to qualify for immediate expensing.

Making the Election and Its Implications

Businesses that select to utilize the de minimis secure harbor election need to connect a declaration to their timely filed federal tax go back and preserve a written accounting coverage outlining the chosen threshold and remedy of prices exceeding the restriction. This election gives numerous advantages, such as:

- Reduced compliance fees: By allowing immediately deductions for qualifying costs, the election removes the want for complicated depreciation calculations and report-keeping for small-dollar assets.

- Simplified tax accounting: The election streamlines the tax submitting technique through eliminating the requirement to capitalize and depreciate certain low-price property.

- Lower administrative burdens: Businesses keep time and resources by means of averting the complexities associated with tracking and depreciating severa small-greenback property.

Qualifying Expenditures and Deductions

The de minimis secure harbor election applies to numerous tangible assets expenses generally incurred by using companies, along with:

- Materials and materials: Raw substances, components, and different gadgets used in manufacturing.

- Personal assets: Equipment, furnishings, and other movable assets used in commercial enterprise operations.

- Buildings and improvements: Costs associated with constructing structures and their improvements.

When the election is made, qualifying costs that meet the cost threshold may be deducted of their entirety all through the yr they are incurred, rather than being unfold out over their beneficial existence thru depreciation. This can offer instant tax blessings for corporations that frequently deal with small-dollar costs on tangible belongings.

Conclusion

The de minimis safe harbor election gives a treasured option for small agencies looking for to simplify their tax submitting process and reduce administrative burdens. By expertise the eligibility standards, price thresholds, and implications of this election, businesses could make knowledgeable selections about their tax submitting strategies and probably benefit from immediate deductions for qualifying small-greenback costs.