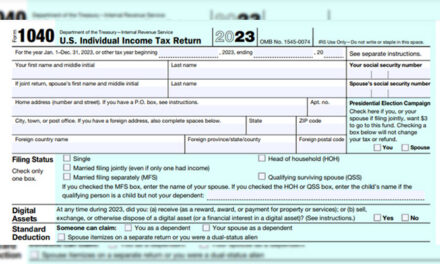

Tax season can be a maze of deadlines, forms, and regulations. For many, hiring a tax professional is a lifesaver—but the wrong choice could lead to costly errors, audits, or even legal trouble. Remember: You’re legally responsible for your tax return, even if someone else prepares it. To help you navigate this critical decision, here’s an in-depth guide with here are 10 IRS tips to help you find a qualified, ethical tax professional.

1. Verify Credentials: CPA, EA, or Tax Attorney

Not all tax preparers have the same expertise. The IRS highlights three primary credentials to prioritize:

Not all tax preparers have the same expertise. The IRS highlights three primary credentials to prioritize:

Certified Public Accountant (CPA)

CPAs are licensed by state boards and must pass rigorous exams covering accounting, auditing, and tax law. They’re authorized to represent clients in IRS audits and appeals. Ideal for complex tax situations, such as business ownership or multi-state filings.

Enrolled Agent (EA)

EAs are federally licensed by the IRS and specialize exclusively in taxation. They can represent taxpayers in all IRS matters, including audits. EAs often handle intricate issues like back taxes or IRS disputes.

Tax Attorney

Tax attorneys are lawyers specializing in tax law. They’re essential for legal disputes, estate planning, or cases involving tax fraud allegations.

Action Step:

Use the free IRS Directory of Federal Tax Return Preparers to search for credentialed professionals by zip code. Filter by “Enrolled Agent” or “CPA” for targeted results.

2. Confirm Their PTIN (Preparer Tax Identification Number)

By law, anyone paid to prepare taxes must have a valid PTIN. This number ensures accountability and tracks preparers’ compliance history.

Red Flags:

- A preparer who hesitates to provide their PTIN.

- A return filed without the preparer’s PTIN or signature.

Why It Matters:

The IRS may reject unsigned returns, delaying your refund. Worse, unscrupulous preparers might use your refund for their gain.

3. Avoid Percentage-Based Fees

Never hire a preparer who charges a percentage of your refund. This structure incentivizes fraud, such as inflating deductions or inventing credits to boost their payout.

Example:

If your refund is 5,000, $500. A flat fee of $300 for a standard return is more transparent and ethical.

Tip:

Ask for a written fee agreement upfront. Reputable preparers charge based on form complexity, not refund size.

4. Prioritize Year-Round Availability

Tax issues don’t end on April 15. You might receive an IRS notice months later or need to amend a return.

Ask Potential Preparers:

- “Will you be available to assist if the IRS contacts me after tax season?”

- “Do you offer audit support?”

Avoid seasonal “pop-up” preparers who vanish after filing deadlines.

5. Investigate Their Complaint History

Before hiring, research their professional standing:

For CPAs:

Check your state’s Board of Accountancy website for disciplinary actions.

For Enrolled Agents:

Search the IRS Office of Enrollment database.

For All Preparers:

- Read Google and BBB reviews.

- Ask for client references.

Red Flag:

Multiple complaints about inaccuracies, hidden fees, or unresponsiveness.

6. Never Sign a Blank or Incomplete Return

A trustworthy preparer will never ask you to sign a blank return. Always review your entire return, including:

- Income sources (W-2s, 1099s).

- Deductions and credits.

- Bank account details for refunds.

Checklist Before Signing:

✅ All income is reported.

✅ Deductions are legitimate and documented.

✅ Refund is routed to YOUR account.

7. Insist on IRS e-File Services

E-filing speeds up processing and reduces errors. The IRS reports that over 90% of refunds are issued within 21 days for e-filed returns with direct deposit.

Avoid Preparers Who:

- Only file paper returns (this delays refunds and increases audit risk).

- Claim they’re “not set up” for e-file.

8. Scrutinize Record-Keeping Practices

A credible preparer will ask for:

- W-2s and 1099s.

- Receipts for deductions (charitable donations, business expenses).

- Prior-year tax returns.

Walk Away If They:

- Encourage you to claim deductions without documentation.

- Suggest inflating numbers “because the IRS won’t notice.”

9. Double-Check Refund Routing

Your refund should go directly to you—not your preparer.

Scam Alert:

Fraudulent preparers may divert refunds to their accounts by falsifying routing numbers. Always verify the banking details on your return.

Protect Yourself:

- Opt for direct deposit.

- Monitor your IRS account via IRS.gov/Account to track refund status.

10. Report Unethical Behavior Immediately

If your preparer engages in misconduct, file a report with the IRS:

- Form 14157: For complaints about fraud, incompetence, or violations.

- Form 14157-A: If a preparer filed or altered your return without consent.

Note: The IRS investigates all preparer complaints and may revoke PTINs for violations.

5 Red Flags of a Dishonest Tax Preparer

- “Guaranteed” Refunds: No preparer can promise specific refund amounts.

- Cash-Only Payments: Legitimate businesses accept checks or cards.

- No Physical Address: Avoid preparers who operate solely online or via social media.

- Pressure to Claim Questionable Credits: E.g., Fuel Tax Credit for non-qualifying individuals.

- Refusal to Provide a Copy of Your Return: You’re entitled to a copy for your records.

How to Prepare for Your First Meeting

Maximize your time with a tax pro by bringing:

-

- Government-issued ID.

- Social Security cards for dependents.

- Income documents (W-2s, 1099s, rental income records).

li>Expense receipts (medical, childcare, business costs).

- Previous year’s tax return.

Ask These Questions:

- “How do you stay updated on tax law changes?”

- “Can you explain the tax implications of [your specific situation, e.g., freelance work]?”

What to Do If You’ve Hired a Bad Preparer

- File an Amended Return: Use Form 1040-X to correct errors.

- Switch Preparers: The IRS allows you to change professionals mid-process.

- Free Help Options: Consider the IRS Free File Program or VITA (Volunteer Income Tax Assistance) if eligible.

Final Checklist for Hiring a Tax Pro

- ✅ Verify PTIN and credentials via the IRS Directory.

- ✅ Compare fee structures (flat fees > percentage-based).

- ✅ Confirm e-file capability and year-round availability.

- ✅ Review the return thoroughly before signing.

- ✅ Ensure refunds are deposited into YOUR account.

At The End

Choosing the right tax professional safeguards your finances and peace of mind. By prioritizing credentials, transparency, and ethics, you’ll minimize audit risks and ensure compliance. For more resources, visit the IRS’s Choosing a Tax Professional guide and stay informed about annual tax law changes.