Late tax payments can result in surprising bills from the IRS come springtime. In response to tightening monetary rules, the IRS has extensively elevated penalties for overdue or misguided bills, specially affecting self-hired people. With hobby costs soaring to their maximum tiers in over two many years, taxpayers want to be vigilant in coping with their tax obligations to keep away from consequences.

Understanding the Penalty Structure

The IRS now imposes an 8% penalty for overdue or erroneous bills, almost triple the preceding fee of 3%. This penalty is calculated by means of adding three percentage factors to the benchmark federal funds price. As a result, an increasing number of taxpayers are facing expected tax penalties, often amounting to numerous hundred bucks.

Strategies for Avoiding Penalties:

Taxpayers can mitigate the chance of consequences with the aid of ensuring they pay as a minimum 90% of their taxes during the year. For W-2 employees, adjusting withholding taxes through the W-4 form with their corporation’s HR or payroll department is a honest option. Additionally, making additional estimated payments can assist cowl any shortfalls.

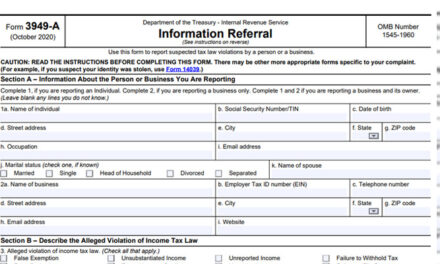

Quarterly Payments for Self-Employed Individuals

Self-employed people, 1099 contractors, and freelancers are advised to pay their taxes quarterly since they don’t have taxes withheld from their earnings. Electronic fee strategies consisting of IRS Online Accounts, Direct Pay, or EFTPS are encouraged for efficiency and comfort.

Expert Advice

Experts recommend paying as a good deal as viable via the deadline to keep away from potential penalties. Michael Hoefke, Director of Enrollment for Community Tax Relief, suggests paying month-to-month in preference to quarterly if feasible, to set up a routine and make certain well-timed payments.

Concluding Thoughts

Failure to make quarterly payments might also lead to penalties in the future. However, timely payment by using the April 15 deadline can assist decrease or take away economic consequences owed to the IRS. By adopting proactive techniques and staying informed about tax obligations, taxpayers can navigate the tax system greater successfully and keep away from unsightly surprises from the IRS.

Sources

“W4 Form 2024 | Filling out the W-4 Tax Form” by Money Instructor

Trackbacks/Pingbacks