Navigating the complex world of the Internal Revenue Service (IRS) can be daunting, even for the most seasoned taxpayers. To help alleviate some of the confusion and anxiety, we’ve compiled a comprehensive list of frequently asked questions (FAQs) covering a wide range of IRS topics. This blog post aims to provide clear, concise, and up-to-date information to empower you to handle your tax obligations with confidence.

1. What is the IRS, and what does it do?

The IRS is the federal agency responsible for collecting taxes, enforcing tax laws, and providing guidance on tax-related matters. It processes tax returns, issues refunds, audits taxpayers, and ensures compliance with U.S. tax regulations.

For an in-depth overview, visit the official IRS About Us page.

2. How do I file my taxes?

You can file taxes in several ways:

- Online Filing: Use IRS-approved software like TurboTax, H&R Block, or the IRS’s Free File Program.

- Paper Returns: Mail a completed tax return to the IRS address listed for your state.

- Professional Assistance: Consult a tax professional for complex returns.

For step-by-step guidance, check out the IRS Filing Options.

3. What are the deadlines for filing taxes?

- Tax Day: Usually falls on April 15. If it lands on a weekend or holiday, the deadline is extended to the next business day.

- Extensions: Submit Form 4868 by the due date to request an automatic extension until October 15. Note that an extension only applies to filing, not payment.

For updates, refer to the IRS Tax Calendar.

4. How can I track my tax refund?

The IRS provides an online tool called “Where’s My Refund?” to track the status of your refund. You’ll need:

- Social Security Number or ITIN.

- Filing status.

- Exact refund amount.

Access the tool here: Where’s My Refund? or download the IRS2Go app.

5. What if I owe taxes and can’t pay?

If you’re unable to pay your taxes in full, the IRS offers options:

- Installment Plans: Pay over time through monthly payments.

- Offer in Compromise (OIC): Settle for less than the amount owed if you qualify.

- Temporary Delay: Request a delay if paying now would cause financial hardship.

Learn more about these options here: IRS Payment Plans.

6. Who qualifies for the Earned Income Tax Credit (EITC)?

The EITC is a refundable tax credit for low- to moderate-income workers. Eligibility depends on:

- Income level.

- Filing status.

- Number of qualifying children (if any).

Use the IRS EITC Assistant to check your eligibility.

7. What should I do if I made a mistake on my tax return?

If you discover an error after filing, you can file an amended tax return using Form 1040-X. This is necessary for correcting errors such as:

- Incorrect income amounts.

- Changing filing status.

- Adding or removing dependents.

For instructions, visit Amending Tax Returns.

8. How do I protect myself from IRS-related scams?

The IRS will never:

- Call or email you demanding immediate payment.

- Threaten legal action without prior written communication.

- Ask for payment via gift cards or wire transfers.

Report suspicious activity to the Treasury Inspector General for Tax Administration and review the IRS Scam Alerts.

9. Can I set up a payment plan with the IRS?

Yes, taxpayers can apply for:

- Short-Term Payment Plans: For balances under $100,000, payable within 120 days.

- Long-Term Installment Agreements: For balances under $50,000, payable over several months.

Apply online here: Online Payment Agreement Application.

10. What is an IRS audit, and how can I avoid one?

An audit is a review of your tax return to ensure accuracy. While audits can happen randomly, you can reduce your chances by:

- Filing accurate and complete returns.

- Avoiding red flags like unusually high deductions.

- Reporting all income, including freelance and gig work.

If audited, learn how to respond here: Understanding the Audit Process.

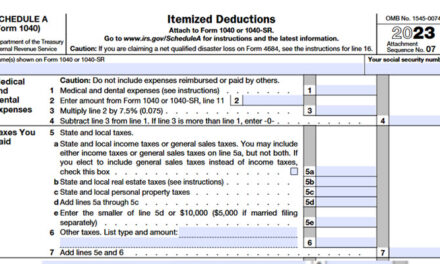

11. Can I claim deductions for working from home?

The home office deduction is available only to:

- Self-employed individuals.

- Freelancers or independent contractors.

W-2 employees generally do not qualify unless they meet specific criteria. Learn more about eligibility here: Home Office Deduction.

12. How long should I keep tax records?

The IRS recommends keeping records for:

- 3 years: For most tax returns.

- 7 years: For claims related to bad debts or losses.

- Indefinitely: If you didn’t file a return or committed fraud.

For more information, visit IRS Recordkeeping Guidelines.

13. What is the Child Tax Credit, and who qualifies?

The Child Tax Credit offers financial relief to families with qualifying dependents. Eligibility includes:

- Children under 17 years old.

- Valid Social Security Numbers for dependents.

- Income limits depending on filing status.

Check eligibility and calculate your credit here: Child Tax Credit Details.

14. What happens if I don’t file my taxes?

Failing to file taxes can result in:

- Late filing penalties (5% of the unpaid taxes for each month late).

- Accruing interest on unpaid balances.

- Legal actions, including liens and garnishments.

Even if you can’t pay in full, file your return and explore payment options here: IRS Payment Options.

15. How do I contact the IRS for help?

You can contact the IRS through multiple channels:

- Phone: Call 1-800-829-1040 for general inquiries.

- Local Assistance: Visit your nearest Taxpayer Assistance Center (TAC).

- Interactive Tools: Use the IRS Interactive Tax Assistant for quick answers.

Final Tips

- Stay Updated: Tax laws change frequently. Visit the IRS Newsroom for announcements.

- File Early: Avoid last-minute errors by filing early.

- Seek Help: Consult a tax advisor for complex issues.

By addressing these common concerns and using the resources provided, you can navigate the tax season with confidence. Have more questions? Check out the IRS FAQs for further assistance.

Disclaimer:

- Please note that tax laws and regulations are subject to change.

- It’s crucial to consult with a tax professional for personalized advice.

- The information provided in this blog post is intended for general knowledge and informational purposes only.