When it comes to retirement planning and managing distributions, IRS Form 1099-R plays a pivotal role. This form reports distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, insurance contracts, and more. Understanding how to read and handle this document is essential for accurate tax filing and avoiding potential penalties. Let’s dive into the details of Form 1099-R, including its components, uses, and implications for your tax obligations.

What Is IRS Form 1099-R?

IRS Form 1099-R is used to report distributions of $10 or more from:

- Pension plans

- Annuities

- Retirement or profit-sharing plans

- Individual Retirement Accounts (IRAs)

- Insurance contracts

- Other similar sources

The form is provided by the payer (e.g., your financial institution or employer) and sent both to you and the IRS. It ensures that the income received from these sources is properly reported for tax purposes.

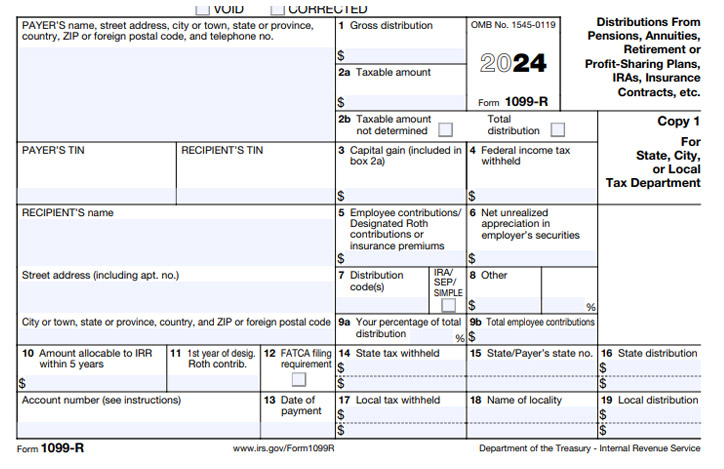

Key Components of Form 1099-R

Understanding the layout and sections of Form 1099-R can help you identify critical information. Here are the primary boxes on the form and what they represent:

- Box 1: Gross Distribution

- The total amount distributed to you during the tax year.

- Box 2a: Taxable Amount

- Indicates the portion of the distribution that is taxable.

- Box 2b: Taxable Amount Not Determined

- If checked, the payer has not calculated the taxable portion, and you must determine it yourself.

- Box 4: Federal Income Tax Withheld

- Reports the amount of federal tax withheld from the distribution.

- Box 5: Employee Contributions or Insurance Premiums

- Shows non-taxable portions like after-tax contributions.

- Box 7: Distribution Code(s)

- Provides a code to identify the type of distribution (e.g., early withdrawal, normal distribution).

- Box 12–16: State and Local Information

- Reports state and local tax details, if applicable.

Common Distribution Codes in Box 7

Box 7 contains essential codes that clarify the nature of the distribution. Some common codes include:

- 1: Early distribution, no known exception (subject to penalty).

- 2: Early distribution, exception applies.

- 3: Disability distribution.

- 4: Death distribution.

- 7: Normal distribution (typically after age 59½).

These codes are crucial for determining whether additional taxes or penalties apply.

Scenarios Requiring Form 1099-R

You will typically receive Form 1099-R in various situations, such as:

- Taking a distribution from an IRA or 401(k) plan.

- Rolling over funds from one retirement account to another.

- Receiving payments from a pension plan.

- Withdrawing funds due to financial hardship or other exceptions.

Tax Implications of Form 1099-R

1. Ordinary Income Tax

Distributions reported on Form 1099-R are generally subject to ordinary income tax. However, exceptions may apply based on the type of account and the reason for the distribution.

2. Early Withdrawal Penalties

If you are under age 59½ and take an early distribution, a 10% penalty may apply unless an exception is met. Examples of exceptions include:

- Disability

- Medical expenses exceeding 7.5% of adjusted gross income (AGI)

- Higher education expenses

3. Required Minimum Distributions (RMDs)

For individuals over age 73 (or 72, depending on the tax year), required minimum distributions must be taken, and these are reported on Form 1099-R. Failing to take RMDs can result in a 25% penalty (reduced to 10% if corrected promptly).

Handling Rollovers and Transfers

Direct Rollovers

If you roll over funds from one retirement account to another, such as a 401(k) to an IRA, the distribution is tax-free if done directly. Form 1099-R will report this transaction, often with Code G in Box 7.

Indirect Rollovers

In an indirect rollover, the payer sends the funds to you, and you must deposit them into another retirement account within 60 days to avoid taxes and penalties. Be aware that 20% is often withheld for taxes.

Transfers

Unlike rollovers, direct transfers between institutions (e.g., trustee-to-trustee transfers) are not reported on Form 1099-R and do not trigger tax obligations.

Steps to Reconcile Form 1099-R on Your Tax Return

- Review the Form for Accuracy

- Verify personal information, gross distribution, taxable amount, and withholding.

- Report the Income on Your Tax Return

- Include the taxable portion of the distribution on your Form 1040, Line 4 or 5 (depending on whether it’s from an IRA or pension).

- Account for Federal and State Tax Withholding

- Use the amounts in Box 4 and state/local boxes to calculate your tax liability.

- Determine if Additional Taxes Apply

- If an early distribution penalty applies, report it on Form 5329.

Frequently Asked Questions About Form 1099-R

Q: When will I receive Form 1099-R?

The form is typically issued by January 31 of the year following the distribution.

Q: What should I do if my Form 1099-R contains errors?

Contact the issuer immediately to request a corrected form (Form 1099-RC).

Q: Is a rollover taxable?

Direct rollovers are not taxable, but indirect rollovers may be subject to withholding unless completed within 60 days.

Q: Do Roth IRA distributions require Form 1099-R?

Yes, but qualified distributions (e.g., after age 59½ and five years of holding) are tax-free.

Tips for Managing Distributions and Taxes

- Plan Distributions Strategically

- Spread distributions over multiple years to avoid jumping into a higher tax bracket.

- Understand Your Retirement Plan Rules

- Review the terms of your retirement accounts to avoid unexpected penalties or taxes.

- Consult a Tax Professional

- Seek guidance for complex scenarios, especially if you’re dealing with early distributions or rollovers.

- Maintain Accurate Records

- Keep copies of Form 1099-R and related documents for at least three years.

Conclusion

IRS Form 1099-R is an essential document for anyone receiving distributions from retirement accounts, pensions, or similar sources. By understanding its components, tax implications, and how to report it correctly, you can manage your retirement funds effectively and stay compliant with IRS regulations. If you’re unsure about any aspect of the form or its impact on your taxes, consulting a financial advisor or tax professional can provide valuable clarity.