The Internal Revenue Service (IRS) provides several forms and resources to help taxpayers stay compliant with tax laws. One of the key tools for maintaining this compliance is Form 3949-A, which allows individuals to report suspected tax violations anonymously. In this guide, we’ll explore the purpose, use, and importance of Form 3949-A, so you can understand how to effectively use it if needed.

What is IRS Form 3949-A?

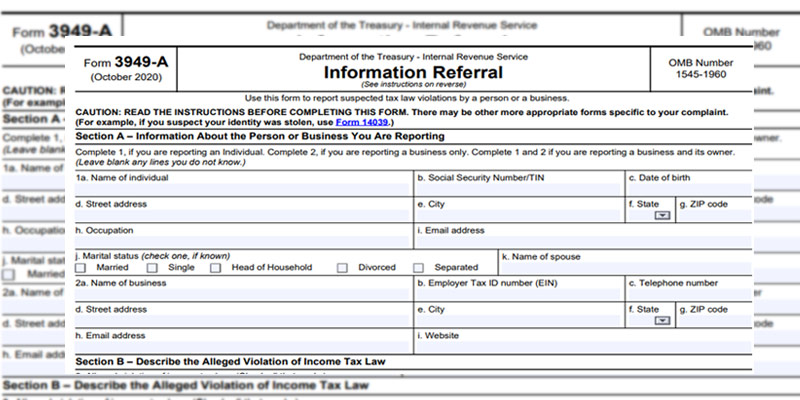

Form 3949-A, officially known as the “Information Referral,” is a voluntary form used to report individuals or businesses that may be violating tax laws. It allows you to alert the IRS to potential tax fraud or non-compliance that you’ve observed, such as unreported income or fraudulent tax filings. This form is part of the IRS’s broader effort to ensure fairness and compliance within the U.S. tax system.

When to Use Form 3949-A

You should consider using Form 3949-A if you believe that someone is committing tax fraud or violating tax laws. Here are a few examples of situations where this form is appropriate:

- Failure to file tax returns: If someone who is required to file taxes isn’t doing so.

- Filing inaccurate or misleading tax returns: For example, misreporting income or deductions.

- Underreporting income: Intentionally not reporting full earnings to reduce tax liability.

- Claiming false deductions or credits: Claiming exemptions, deductions, or credits that aren’t legitimate.

- Other tax violations: This could include failing to withhold taxes, participating in tax fraud schemes, or giving false information to the IRS.

However, it’s crucial to know that Form 3949-A is not a catch-all form for all tax-related issues. In certain cases, other forms are more appropriate, as outlined below.

When Not to Use Form 3949-A

There are some situations where Form 3949-A should not be used. Instead, you should refer to the correct forms for specific issues:

- Identity Theft: If you’re a victim of identity theft, where someone uses your Social Security number to file fraudulent returns, use Form 14039 (Identity Theft Affidavit).

- Tax Preparer Misconduct: If your tax preparer has engaged in unethical behavior, such as submitting false returns on your behalf, file a complaint using Form 14157 (Return Preparer Complaint).

- Unauthorized Filing by a Preparer: If your tax preparer has filed a return without your consent, you’ll need Form 14157 and Form 14157-A (Return Preparer Fraud or Misconduct Affidavit).

What Information Do You Need for Form 3949-A?

To properly complete Form 3949-A, you’ll need to provide detailed and accurate information. Here’s what you should be prepared to include:

- Suspected Violator’s Information: Provide the name, address, and Social Security number (if available) of the individual or business suspected of tax violations.

- Alleged Violation Type: Check one of the pre-listed types of tax violations, such as failure to file or underreporting income. If the specific violation isn’t listed, describe it in the provided space.

- Details of the Alleged Violation: In your own words, explain why you believe the person or business has violated tax laws. Include specific facts, dates, and any evidence you have.

- Supporting Documentation: If you have documents (e.g., bank statements, emails) to support your claim, you can indicate that you have them. You don’t need to attach these documents with your form, but it’s helpful to note their availability.

- Your Contact Information: You may choose to remain anonymous, or you can provide your contact details if the IRS needs to reach you for additional information. Providing your details is optional and does not affect the processing of the form.

For more details on how to fill out Form 3949-A, you can visit the official IRS instructions page.

Confidentiality and Follow-Up

One of the key advantages of Form 3949-A is that the IRS maintains the confidentiality of your identity if you choose to remain anonymous. Your personal details will not be disclosed to the individual or business that you report.

After you submit Form 3949-A, the IRS will review the information and determine if an investigation is warranted. Due to privacy laws, the IRS is unable to provide any follow-up information or updates about the case. This means that even though your report could lead to an investigation, you won’t be informed about the outcome.

For more on IRS confidentiality policies, see their official privacy guidelines.

Ethical Use of Form 3949-A

While Form 3949-A is an important tool for maintaining tax compliance, it must be used responsibly. Filing a report based on personal disputes, inaccurate information, or malicious intent can have serious legal consequences. You could face penalties if your report is proven to be false or intentionally misleading.

If you have genuine concerns and believe that someone is violating tax laws, it’s critical to ensure that your information is accurate before filing. If you’re unsure, consult with a qualified tax professional or legal advisor for guidance.

Frequently Asked Questions (FAQ)

1. Can I file Form 3949-A anonymously?

Yes, you can submit the form without providing your name or contact details. The IRS will review the information based solely on the details you provide.

2. Will I receive updates from the IRS after filing Form 3949-A?

No, the IRS does not provide updates or information about the outcome of the report due to privacy regulations.

3. What happens after I file Form 3949-A?

Once the IRS receives your form, they will review the information and decide whether an investigation is warranted. However, they are not required to notify you of their findings.

4. Can I attach supporting documents to Form 3949-A?

No, you cannot attach documents directly to Form 3949-A. However, you should indicate on the form if you have supporting evidence, and the IRS may reach out for further information.

For more FAQs on IRS forms and tax fraud reporting, visit the IRS Help Center.

Conclusion

Form 3949-A is a valuable resource for ensuring that tax laws are followed. If you suspect tax violations such as underreporting income or claiming false deductions, this form provides a way to inform the IRS. However, it’s important to use this tool responsibly and ensure that your concerns are based on legitimate tax issues.

If you’re unsure whether Form 3949-A is the right form for your situation, consult with a tax professional or visit the IRS website for additional resources and guidance.

Trackbacks/Pingbacks