Ever puzzled how to reconcile your medical health insurance premium tax credit with the IRS? If you acquire economic assistance to afford medical insurance thru the Marketplace (also called an Exchange), then Form 8962 is your key to tax time peace of mind. This weblog post may be your one-forestall save for expertise everything approximately Form 8962: its uses, advantages, and a way to navigate its final touch.

What is Form 8962 and Why Do I Need It?

Form 8962 is an official Internal Revenue Service (IRS) document used specifically for the Premium Tax Credit (PTC). The PTC is a financial assistance program available through the Health Insurance Marketplace that helps eligible individuals and families lower their monthly health insurance premiums.

Here’s the catch: the Marketplace estimates your PTC eligibility based on your projected income for the year. When you file your tax return, you report your actual income. This is where Form 8962 comes in. It helps you:

- Calculate your actual PTC amount: Based on your final income for the tax year, you can determine the exact PTC you’re eligible for.

- Reconcile Advance Payments of PTC (APTC): Throughout the year, the Marketplace sends advance payments (APTC) directly to your insurance company to help cover your premiums. Form 8962 compares the total APTC received with your final PTC amount.

- Determine Repayment of Excess APTC (if applicable): If the total APTC payments were more than your actual PTC eligibility, you may need to repay some of the difference to the IRS.

In simpler terms, Form 8962 ensures you’re receiving the correct amount of PTC benefit and helps settle any discrepancies between estimated and actual income.

Who Should Use Form 8962?

Generally, anyone who received an APTC for health insurance purchased through the Marketplace during the tax year needs to file Form 8962 with their tax return. This includes:

- Individuals who received APTC for their own coverage.

- Individuals who received APTC to cover a spouse or dependents.

- Someone who enrolled another person in your tax family for Marketplace coverage and APTC payments were made.

There are a few exceptions, though. You don’t need to file Form 8962 if:

- You didn’t receive any APTC payments during the year.

- You reported zero household income on your tax return.

- You filed Form 1040-SS (School Tax Return) or Form 1040-PR (Puerto Rico Resident Return).

Benefits of Using Form 8962

Filing Form 8962 accurately ensures several benefits:

- Receive the Correct PTC Amount: By calculating your actual PTC, you can claim the full benefit you’re entitled to on your tax return, potentially leading to a larger tax refund.

- Avoid Repayment Confusion: Completing Form 8962 clarifies any potential discrepancies in APTC payments and helps you determine the exact repayment amount, if any, to the IRS.

- Peace of Mind: Accurate tax filing reduces the risk of future audits or penalties from the IRS.

How to Use Form 8962: A Step-by-Step Guide

Ready to tackle Form 8962? Here’s a breakdown of the process:

1. Gather Information:

Before you begin, collect the following documents:

- IRS Form 1095-A: This form, provided by the Marketplace, details your health plan information and the total APTC amount received for the year. You’ll need information from Lines 14 and 16.

- Tax return documents: Have your tax return forms handy, such as your income information and filing status.

2. Download and Print the Form:

Head to the IRS website (https://www.irs.gov/forms-pubs/about-form-8962) to download the latest version of Form 8962 and its instructions. Print a physical copy or use the online fillable version if your tax software supports it.

3. Complete the Form:

The form itself is divided into several sections. Here’s a simplified breakdown of the key parts:

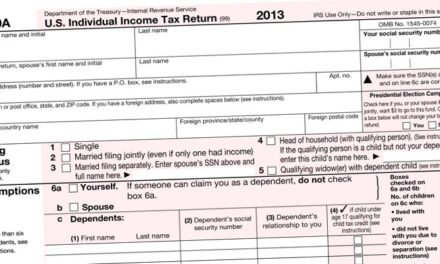

- Part I – Taxpayer Information: Enter your personal details like name, Social Security number, and filing status.

- Part II – Marketplace Information: Indicate the Health Insurance Marketplace you used and whether you’re allocating policy amounts with another taxpayer (applicable in certain situations).

- Part III – Policy Information: Here’s where you’ll use your Form 1095-A. Enter the policy number, total months of coverage for each enrolled.

3. Complete the Form (continued):

- Part III – Policy Information (continued): Enter the policy number, total months of coverage for each enrolled individual, and the total APTC amount from Line 14 of Form 1095-A for each policy.

- Part IV – PTC Calculation: This section uses your income information and filing status to calculate your actual PTC eligibility. You may need to refer to the Form 8962 instructions for specific calculations.

- Part V – Reconciliation: Here, you compare the total APTC received (from Line 16 of Form 1095-A) with your calculated PTC from Part IV. The form will determine if you qualify for an additional PTC or need to repay excess APTC.

4. Review and Attach:

- Carefully review all the information you entered on the form for accuracy.

- Attach Form 8962 to your completed tax return before submitting it to the IRS.

Additional Tips for Using Form 8962:

- Keep Copies: Maintain copies of your completed Form 8962 along with your tax return documents for your records.

- Seek Help if Needed: If you encounter any difficulties understanding or completing the form, consider seeking assistance from a tax professional or using IRS resources like their online chat function or toll-free helpline.

- Marketplace Website: The Marketplace website (https://www.healthcare.gov/) also offers resources and FAQs related to Form 8962.

In Conclusion:

Form 8962 empowers individuals and families to access the financial assistance they need to afford health insurance coverage while promoting transparency and accountability in the tax system. By harnessing the benefits of this form, you can take control of your healthcare expenses and ensure a smoother tax filing experience.

Trackbacks/Pingbacks