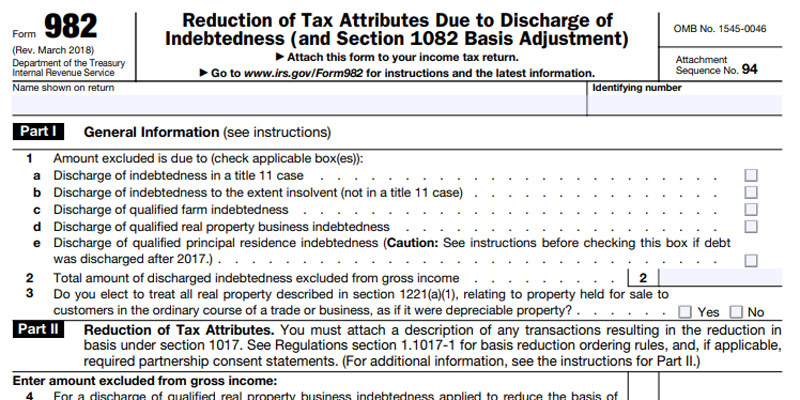

If you’ve got skilled a scenario wherein a debt you owe is forgiven or canceled, you would possibly come upon tax implications. IRS Form 982 performs a vital role in navigating this situation, assisting you report the “discharge of indebtedness” and potentially exclude it from your taxable profits beneath particular situations mentioned inside the Internal Revenue Code section 108. While no longer immediately related to creating a web weblog, this manual aims to provide a clear and informative review of Form 982, empowering you to make informed selections approximately its use.

Key Points approximately Form 982

- Purpose: Used to record the exclusion of discharged debt from taxable profits under unique situations legal via phase 108 of the IRS Code.

- Who Should Use It: Individuals or corporations that have had a debt forgiven or canceled, potentially ensuing in tax effects.

- When to File: Attach Form 982 in your federal profits tax go back for the yr the debt discharge occurred.

- Completing the Form: Refer to the legit IRS instructions (https://www.Irs.Gov/pub/irs-pdf/i982.Pdf) for unique steerage, as the form itself may alternate over time.

Benefits of Using Form 982

- Reduce Taxable Income: If your debt discharge qualifies for exclusion underneath segment 108, filing Form 982 enables you avoid paying taxes on the forgiven amount, doubtlessly reducing your normal tax burden.

- Compliance with Tax Regulations: Using Form 982 demonstrates your adherence to IRS policies, minimizing the chance of penalties or audits.

Common Usages of Form 982

- Bankruptcy or Foreclosure: When a debt is discharged via a bankruptcy or foreclosures intending, Form 982 allows you to document the exclusion if sure standards are met.

- Debt Forgiveness with the aid of a Creditor: If a creditor voluntarily forgives a portion or all your debt, Form 982 may be used to assert the exclusion if it satisfies particular conditions.

- Short Sales of Real Estate: In cases where the sale of actual estate fails to cover the notable mortgage, Form 982 might be important to file the discharged debt element.

Important Considerations

- Consult a Tax Professional: Due to the complexities of tax law, it’s strongly recommended to are seeking steering from a certified and skilled tax professional, in particular for conditions regarding sizeable debt discharge. They will let you decide if Form 982 is relevant and ensure right crowning glory for max benefit.

- Not Guaranteed Exclusion: Not all debt discharge qualifies for exclusion under section 108. Factors like the kind of debt, the reason of discharge, and your monetary state of affairs can affect eligibility. Consulting a tax expert is important to verify if your situation qualifies for exclusion.

- Compliance and Accuracy: Ensure you accurately and carefully whole all sections of Form 982, following the commands provided with the aid of the IRS. Filing accurate and complete records is critical to preserve compliance and avoid potential problems with the IRS.

Additional Resources

- IRS Form 982 and Instructions: https://www.Irs.Gov/pub/irs-pdf/f982.Pdf

- IRS Section 108 (Exclusion of Discharge of Indebtedness): https://www.Irs.Gov/pub/irs-drop/rr-12-14.Pdf

- IRS Publications and Forms: https://www.irs.gov/forms-instructions

By information the purpose, application, and complexities related to Form 982, you could make knowledgeable choices approximately its use to your specific scenario. Always take into account, consulting a certified tax professional is the quality course of action to navigate tax-related subjects regarding debt discharge and ensure accurate reporting for most effective consequences.

I loved as much as you will receive carried out right here The sketch is attractive your authored material stylish nonetheless you command get got an impatience over that you wish be delivering the following unwell unquestionably come more formerly again since exactly the same nearly a lot often inside case you shield this hike