The Internal Revenue Service (IRS) has taken a significant step toward modernizing the tax filing process. In a recent announcement, the IRS revealed that taxpayers can now access key information return documents, such as Form W-2 and Form 1095-A, directly through their IRS Individual Online Account. This move is part of the agency’s ongoing efforts to make tax filing more convenient, secure, and efficient for millions of Americans.

In this blog, we’ll explore what this update means for taxpayers, how to access these forms, and the additional features available through the IRS Individual Online Account. Whether you’re a seasoned filer or new to the process, this guide will help you navigate the changes and make the most of the IRS’s digital tools.

What’s New? W-2 and 1095-A Forms Added to Online Accounts

Starting with tax years 2023 and 2024, taxpayers can now access their Form W-2, Wage and Tax Statement, and Form 1095-A, Health Insurance Marketplace Statement, under the “Records and Status” tab in their IRS Individual Online Account. These forms are essential for accurate tax filing and having them available online eliminates the need to wait for paper copies or track down digital versions from employers or insurers.

- Form W-2: This form reports your annual wages and the taxes withheld by your employer. It’s a critical document for filing your federal and state tax returns.

- Form 1095-A: This form provides details about your health insurance coverage through the Marketplace, which is necessary for reconciling premium tax credits.

By consolidating these forms in one digital location, the IRS is making it easier for taxpayers to access and organize their tax information.

How to Access Your IRS Individual Online Account

If you don’t already have an IRS Individual Online Account, setting one up is quick and easy. Here’s how:

- Visit the IRS website at Online Account for Individuals.

- Click on the “Create or View Your Account” button.

- Follow the prompts to verify your identity using ID.me, a secure identity verification platform.

- Once verified, you’ll have access to your Online Account, where you can view your tax records, including the newly added W-2 and 1095-A forms.

For a step-by-step guide on setting up your account, check out this IRS PDF guide.

What Else Can You Do with an IRS Individual Online Account?

The addition of W-2 and 1095-A forms is just one of many features available through the IRS Individual Online Account. Here are some other ways you can use this powerful tool:

- View Key Tax Details: Access important information from your most recent tax return, such as your Adjusted Gross Income (AGI).

- Request an Identity Protection PIN: Protect yourself from tax-related identity theft by obtaining a unique PIN.

- Check Refund Status: Track the status of your tax refund in real time.

- Access Account Transcripts: View wage and income records, as well as other tax-related documents.

- Sign Tax Forms Electronically: Authorize powers of attorney or tax information authorizations without paper forms.

- Manage Language Preferences: View and edit your language preferences for IRS communications.

- Receive Electronic Notices: Access over 200 IRS notices online instead of waiting for mailed copies.

- Make and Cancel Payments: Manage your tax payments directly through your account.

- Set Up Payment Plans: Arrange installment agreements if you owe taxes and need more time to pay.

- Check Your Balance: View your current tax balance and payment history.

These features make the IRS Individual Online Account a one-stop shop for managing your tax obligations and staying informed about your financial records.

For more details on these features, visit the IRS Online Account FAQ page.

Important Considerations

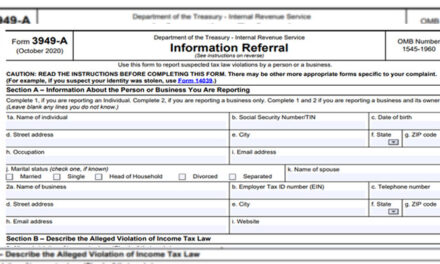

While the addition of W-2 and 1095-A forms to the Online Account is a welcome change, there are a few important things to keep in mind:

- Spousal Accounts: If you’re married, your spouse will need to log into their own Online Account to access their information return documents. This applies whether you file jointly or separately.

- State and Local Tax Information: The Online Account does not include state and local tax details, even if they’re listed on your Form W-2. Be sure to keep any paper or digital records provided by your employer or payer.

- Missing or Incorrect Documents: If you don’t receive a required form or notice an error, contact the issuer (e.g., your employer or insurer) immediately to request a corrected copy.

For more information on handling missing or incorrect forms, refer to IRS Topic No. 154.

Tips for a Smooth Tax Filing Experience

- File on Time: Even if you’re missing a document, it’s important to file your tax return by the deadline (April 15 for most filers). You can always amend your return later if needed.

- Keep Records: While the IRS is moving toward digital records, it’s still a good idea to keep physical or digital copies of all your tax documents.

- Use IRS Resources: Visit IRS.gov for guides, FAQs, and tools to help you navigate the tax filing process.

For a comprehensive guide on tax filing, download the IRS Publication 17.

The Future of IRS Digital Services

The addition of W-2 and 1095-A forms to the Individual Online Account is just the beginning. The IRS has announced plans to add more information return documents in the coming months, further streamlining the tax filing process.

This modernization effort reflects the IRS’s commitment to leveraging technology to improve taxpayer experiences. By providing secure, easy-to-access digital tools, the agency is helping taxpayers save time and reduce stress during tax season.

Conclusion

The IRS’s decision to add W-2 and 1095-A forms to Individual Online Accounts is a game-changer for taxpayers. It simplifies the process of accessing critical tax documents, reduces the risk of errors, and makes tax planning more efficient.

If you haven’t already, take a few minutes to create or log into your IRS Individual Online Account. Explore the features, access your forms, and take control of your tax filing process. With these new tools at your fingertips, tax season doesn’t have to be a headache—it can be a seamless, stress-free experience.

For more information, visit IRS.gov or check out Topic No. 154, which provides guidance on what to do if your W-2 or 1099-R forms are incorrect or missing.

By staying informed and taking advantage of the IRS’s digital resources, you can make tax season a breeze. Happy filing!

Additional Resources:

- IRS Online Account for Individuals

- IRS Publication 17: Your Federal Income Tax

- Topic No. 154: Form W-2 and Form 1099-R

- IRS Identity Protection PIN Information

These links provide valuable tools and information to help you navigate tax season with confidence.

By staying informed and taking advantage of the IRS’s digital resources, you can make tax season a breeze.

Happy filing!