As tax season approaches, many people find themselves at a crossroads—should they claim the same old deduction or itemize their deductions? For the ones thinking about the latter, knowledge miscellaneous deductions becomes paramount. In this manual, we’re going to resolve the intricacies of miscellaneous deductions, losing light on seven essential factors that could impact your tax go back.

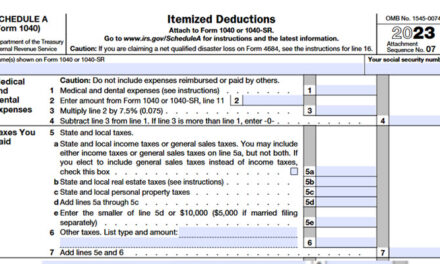

Schedule A Reporting:

To embark on the journey of saying miscellaneous deductions, you should first report IRS Form 1040 and itemize your deductions on Schedule A. However, it’s essential to word that if the total of your miscellaneous deductions plus different itemized deductions falls short of the same old deduction, opting for the standard deduction might be greater fine.

Tax Preparation Fees:

Delving into the area of miscellaneous deductions opens up avenues for claiming tax education fees. Whether you operate tax training software program or enlist the offerings of a professional tax preparer, the incurred fees are deductible. Ensure these expenses align with the tax year for that you’re submitting, allowing you to maximise your deductions.

Business Expenses for Non-Business Owners:

If your task calls for you to put money into essential items, you may qualify for a miscellaneous deduction. This includes charges like paintings-associated courses, but pay attention—you cannot declare the deduction if your enterprise reimbursed you or if you gained massive blessings from the fees.

2% Threshold and Beyond:

Be mindful of the 2% threshold that applies to many miscellaneous deductions. This manner you could handily deduct the portion of your costs that exceeds 2% of your Adjusted Gross Income (AGI). Unreimbursed worker expenses, union dues, and paintings-related journey fall into this category. However, losses from Ponzi schemes, gambling losses, and certain casualty and theft losses are exempt from this restriction.

Hobby Expenses Deduction:

If you’re engaged in a money-making interest that does not qualify as a Schedule C commercial enterprise, you’ll be eligible for a miscellaneous deduction. However, you may most effectively deduct costs as much as the quantity of income generated from the hobby, and meticulous recordkeeping is crucial.

Ponzi Scheme and Gambling Losses:

A silver lining for the ones who’ve fallen sufferer to Ponzi schemes—your losses may be claimed as a miscellaneous deduction. Additionally, in case you partake in legal gambling, your losses may be deducted, furnished they do now not exceed your winnings.

Navigating Strange Deductions:

The term “miscellaneous” may additionally evoke notions of a catch-all category, but the IRS has stringent guidelines. Unreimbursed business charges regularly turn out to be the breeding floor for creative deductions, attracting extra scrutiny from the IRS. Maintaining thorough information and searching for professional help is advisable for complicated situations.

Conclusion:

As you embark on the adventure of claiming miscellaneous deductions, it’s critical to navigate the intricate landscape with precision. Understanding the nuances of Schedule A reporting, the 2% threshold, and the unique categories eligible for deductions will empower you to make informed selections come tax season. Remember, a well-documented approach and adherence to IRS guidelines will ensure a smoother and greater fruitful tax-submitting revel in. For further insights, seek advice from IRS Publication 529 on Miscellaneous Deductions.

For a comprehensive understanding of miscellaneous deductions and further details, refer to IRS Publication 529(Miscellaneous Deductions), available from the Internal Revenue Service.