In the realm of tax duties, handling payments to the Internal Revenue Service (IRS) may be a frightening mission, specially for self-hired individuals and enterprise proprietors. However, the IRS gives a lifeline inside the shape of installment agreements, permitting taxpayers to unfold out their payments over the years. Central to this technique is IRS Form 433-D, a vital record for putting in place direct debit installment agreements. In this complete guide, we’re going to delve into the intricacies of Form 433-D, exploring its cause, requirements, terms, and conditions, at the same time as also evaluating it to different associated bureaucracy.

Understanding Form 433-D: Setting Up Your Payment Plan

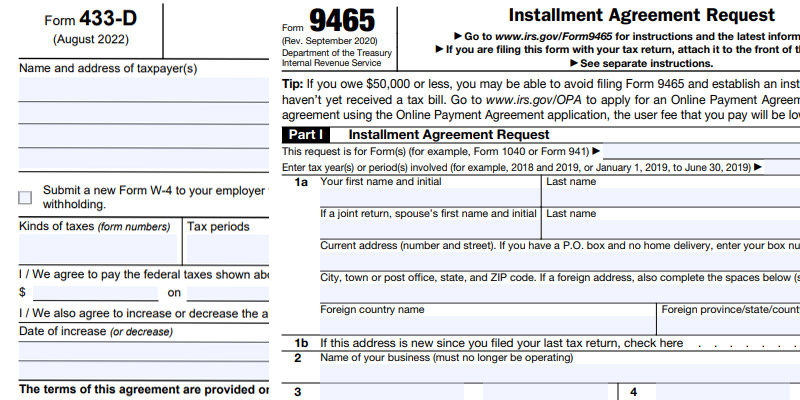

Form 433-D serves as the cornerstone for taxpayers searching for to set up an immediate debit installment settlement with the IRS. This shape enables the supply of critical economic and private statistics important for assessing one’s ability to fulfill monthly fee duties. Here’s a step-via-step breakdown of completing Form 433-D:

Personal Information: Begin by means of furnishing your name, social security variety, and taxpayer fame.

Financial Details: Provide comprehensive economic records, which includes month-to-month earnings, prices, and any extra information pertinent on your monetary scenario.

Payment Plan Specifications: Indicate the type of payment plan you’re in search of, together with proposed monthly payment quantities and initial payment proposals.

Business Information (if applicable): For sole owners or self-employed individuals, consist of applicable details about business earnings and costs.

Certification: Sign and date the form to certify the accuracy of the facts furnished.

Eligibility and Usage of Form 433-D

Form 433-D in the main caters to self-hired people, enterprise proprietors, and taxpayers with extremely good federal taxes, including delinquent employment taxes, private or commercial enterprise earnings taxes, or accept as true with fund healing penalties. Assessing one’s monetary potential to make monthly bills is crucial in figuring out eligibility for utilising Form 433-D.

Terms and Conditions: Fulfilling Your Obligations

By finishing Form 433-D and agreeing to its phrases, taxpayers commit to pleasing their responsibilities underneath the installment agreement. This involves making well timed monthly payments and adhering to the agreed-upon charge agenda. Failure to conform can also bring about penalties, interest prices, or escalated collection moves via the IRS, together with tax liens or salary garnishments.

Addressing Missed Payments: Proactive Communication

In the occasion of an anticipated neglected payment, proactive conversation with the IRS is paramount. Contacting the IRS right away permits for discussing opportunity preparations to mitigate the state of affairs, such as brief suspension of bills or amendment of the installment agreement terms. Transparent speak demonstrates willingness to solve issues and may prevent further economic repercussions.

Filing Tax Returns and Refunds: Continuing Compliance

While on an installment agreement, taxpayers should keep filing tax returns right away. Although tax refunds may be applied to awesome tax debt, pleasant tax obligations stays imperative. Compliance guarantees ongoing progress closer to resolving tax liabilities and demonstrates commitment to assembly economic obligations.

Understanding Service Fees: Budgeting for Payments

Awareness of IRS service expenses associated with installment agreements is essential for financial planning. These fees encompass setup charges, reinstatement charges, and ongoing person costs. Staying knowledgeable approximately applicable fees permits taxpayers to finances accordingly and keep away from economic surprises.

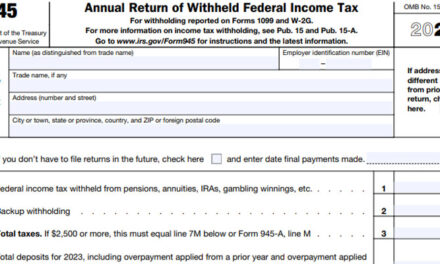

Differentiating Form 433-D and Form 9465

Form 433-D and Form 9465 serve awesome functions within the realm of IRS installment agreements. While both facilitate the setup of charge plans, Form 433-D requires complete monetary statistics and is generally utilized by people with complex monetary conditions. Conversely, Form 9465 is easier and more sincere, catering to taxpayers with lower tax liabilities.

Exploring Other 433 Forms: A Brief Overview

In addition to Form 433-D and Form 9465, diverse other forms play roles in IRS series methods. These encompass Form 433-A for salary earners and self-hired individuals, Form 433-A (OIC) for Offer in Compromise requests, Form 433-F for simplified collection records, and Form 433-B for corporations and sole proprietorships. Each form serves precise functions in assessing taxpayers’ economic situations.

Conclusion:

In navigating the complexities of IRS installment agreements, expertise Form 433-D and its implications is paramount. By providing accurate financial facts and adhering to the phrases of the settlement, taxpayers can correctly manage their tax obligations and work in the direction of monetary stability. Consulting with tax professionals can in addition optimize the technique, making sure compliance and maximizing the probability of settlement approval. With proactive communication, economic diligence, and knowledgeable choice-making, taxpayers can navigate IRS installment agreements with self-assurance and clear up their tax liabilities successfully.

Sources

“IRS Form 433-D walkthrough (Setting up an Installment Agreement)” – Teach Me! Personal Finance