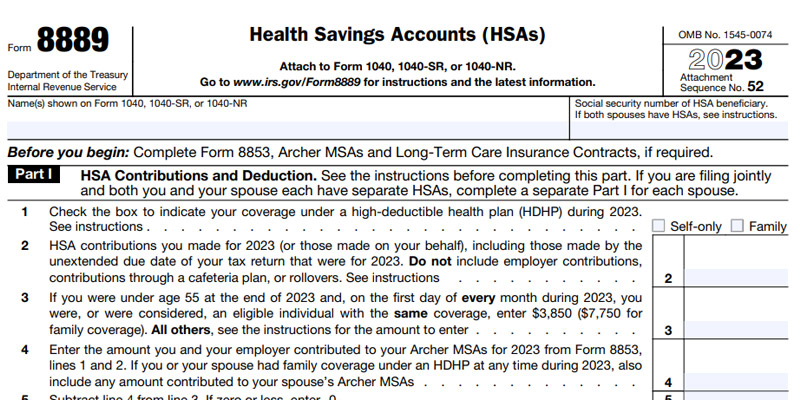

To report Health Savings Account (HSA) contributions, distributions, or adjustments, follow these steps with IRS Form 8889:

- Navigate to the Federal section of the tax software.

- Look for the Deductions option and select My Forms.

- Find Adjustments to Income and select Health Savings Account Form 8889.

Understanding HSA Contributions?

Health Savings Accounts (HSAs) are tax-exempt accounts designed to assist with medical expenses. Contributions to an HSA are typically deductible. If you’ve made contributions to an HSA, you should receive Form 5498-SA, which details your contribution information. Ensure that Box 6 is checked, indicating it is an HSA account.

Important Considerations:

- Contributions through your employer’s cafeteria plan should not be double-reported in the tax software.

- Contributions reported on W-2 Box 12 with Code W represent pretax dollars and aren’t eligible for an additional tax deduction.

Additional Information:

- If you’re 55 or older at the end of the tax year, you can make an extra contribution of $1,000, as per IRS guidelines.

- The maximum HSA contribution is reduced by employer contributions, Archer MSA contributions, or qualified HSA funding distributions.

Stay compliant with these guidelines to accurately report HSA activities and maximize your tax benefits.

For further details and comprehensive information, please consult the IRS Instructions for Forms 1099-SA and 5498-SA. These instructions provide in-depth guidance on reporting and understanding HSA distributions, contributions, and other relevant aspects.

Understanding HSA Distributions?

HSA distributions refer to any withdrawals made by the account owner. If these withdrawals are exclusively used for qualified medical expenses for the account beneficiary, their spouse, or dependents, they are excluded from gross income. It’s crucial to report the entire distribution amount as indicated on your 1099-SA. Additionally, you must specify the portion of the distribution utilized for qualified medical expenses. If any part of the distribution remains unused for qualified expenses, that remainder becomes taxable income, reported on line 1 of your tax return.

Calculating HSA Deduction?

To calculate your Health Savings Account (HSA) deduction, consider the type of High Deductible Health Plan (HDHP) coverage you have. For self-employed individuals with coverage, the maximum contribution is $3,850, while those with family coverage can contribute up to $7,750. The program will automatically compute your deduction based on the information you provide.

Stay mindful of these guidelines to ensure accurate reporting of HSA distributions and deductions, maximizing your tax benefits.

For additional details, please consult the IRS Form 8889 instructions for more information.

For form, please consult the IRS Form 8889 form for more information.

May I request more information on the subject? All of your articles are extremely useful to me. Thank you!

I’m so in love with this. You did a great job!!

Thank you for writing this post. I like the subject too.

Please tell me more about this. May I ask you a question?

F*ckin?tremendous issues here. I am very glad to look your article. Thank you a lot and i’m taking a look forward to touch you. Will you kindly drop me a mail?

Of course, what a magnificent site and educative posts, I definitely will bookmark your site.All the Best!

Hello, you used to write fantastic, but the last few posts have been kinda boring?I miss your super writings. Past few posts are just a little bit out of track! come on!

Hello There. I found your blog using msn. This is a very well written article. I will make sure to bookmark it and return to read more of your useful information. Thanks for the post. I抣l certainly return.

Hello, i believe that i noticed you visited my web site thus i return the choose?I’m attempting to find things to enhance my web site!I suppose its adequate to make use of a few of your ideas!!

What抯 Happening i am new to this, I stumbled upon this I have found It absolutely useful and it has helped me out loads. I hope to contribute & help other users like its helped me. Good job.

I do trust all the concepts you’ve offered on your post. They’re really convincing and can certainly work. Still, the posts are too quick for beginners. May you please prolong them a bit from next time? Thank you for the post.

Great goods from you, man. I have understand your stuff previous to and you are just too excellent. I really like what you have acquired here, certainly like what you’re saying and the way in which you say it. You make it entertaining and you still take care of to keep it sensible. I can not wait to read far more from you. This is actually a wonderful website.

I am often to running a blog and i really recognize your content. The article has really peaks my interest. I am going to bookmark your site and maintain checking for brand new information.

This actually answered my problem, thanks!

Nice post. I was checking continuously this blog and I am inspired! Extremely helpful info specifically the remaining section 🙂 I handle such information much. I was looking for this certain info for a very lengthy time. Thank you and good luck.