If you’re new to the concept of the scientific expense deduction, get ready for a nice revelation. The Internal Revenue Service (IRS) gives taxpayers a treasured danger to alleviate their tax burdens via deducting qualifying scientific and dental fees. Ranging from recurring health practitioner’s visits to prescription drug treatments, the scope of deductible charges is full-size. This guide is your key to navigating the intricacies of the medical expense deduction, ensuring you harness this tax-saving opportunity to the fullest.

1: Qualifying for the Medical Expense Deduction

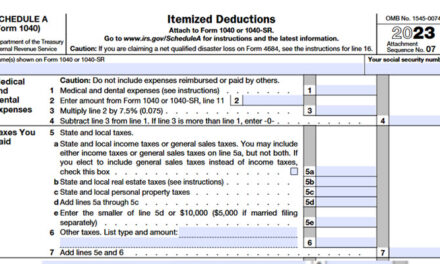

To declare the medical fee deduction, you may want to itemize your deductions on Schedule A (Form 1040) and meet the requirement of having deductible clinical expenses exceeding 7.5% of your adjusted gross profits (AGI). This phase gives insights into eligible charges, masking the entirety from scientific practitioners’ charges to hospital care and preventive measures.

2: Understanding Deductible Medical Expenses

Delve into the extensive listing of deductible scientific fees, from bills to healthcare experts to fees related to persistent contamination-related meetings. Understand what the IRS considers legitimate scientific fees, making sure each deduction is substantiated with a clear hyperlink to a clinical circumstance or dental cost.

3: Unveiling five Lesser-Known Medical Deductions

Explore unexpected clinical deductions, which include the ability to deduct mileage for medical remedy. Learn a way to calculate and report your scientific transportation fees, along with mileage, gas, tolls, and parking. Uncover lesser-recognized deductions like charges for acupuncture remedies and participation in smoking-cessation packages.

4: Navigating Non-Covered Medical Expenses

Understand the constraints of hospital therapy coverage, which include charges deemed beneficial to popular fitness, along with vitamins or holidays. Gain insights into what your healthcare plan won’t cowl, like over-the-counter medicinal drugs, beauty techniques, and fashionable health club dues.

5: Maximizing Dental Expense Deductions

Dive into the sector of dental expense deductions, from recurring cleanings to main dental approaches. Learn which dental expenses are deductible, including insurance premiums, and discover a way to tune and record those expenses throughout the yr.

6: Deducting Insurance Premiums with the Medical Expense Deduction

Decipher the complexities of deducting coverage rates, thinking about factors like self-employment and Adjusted Gross Income (AGI). Understand the styles of coverage premiums that are commonly deductible and the limitations related to organisation-subsidized coverage.

7: Unveiling Flexible Health Savings Accounts (HSAs)

Consult IRS Publication 502 for complete suggestions on reimbursable charges from a Health Flexible Spending Account (FSA). Discover eligible fees for clinical services, prescription medications, and certain dental and imaginative and prescient care services. Gain readability on what prices can not be reimbursed, together with over-the-counter medications and cosmetic procedures.

8: IRS Publication 502: Your Ultimate Resource

Explore the wealth of statistics provided by using IRS Publication 502, the move-to resource for claiming clinical and dental charges as itemized deductions. Understand the eligibility standards, limitations, and regulations associated with various charges. Make the most of this valuable aid for tax making plans and healthcare spending.

9: The Health Coverage Tax Credit (HCTC)

Uncover the benefits of the Health Coverage Tax Credit (HCTC), designed to assist eligible people in affording medical health insurance. Learn about qualifications, including eligibility via Trade Adjustment Assistance and Pension Benefit Guaranty Corporation payments. Don’t miss out on this opportunity to ease your healthcare coverage fees.

10: Dependent Care Tax Credit: A Closer Look

Navigate the necessities and barriers of the Dependent Care Tax Credit mentioned in IRS Publication 502. Understand eligible expenses for infant and based care, along with daycare and babysitting services. Ensure compliance with precise criteria to maximize tax savings for based care prices.

11: Itemizing Deductions on Schedule A

Grasp the choice between taking the standard deduction or listing deductions on Schedule A. Learn the advantages of listing, probably lowering your taxable income by list eligible prices along with mortgage interest, belongings taxes, and charitable contributions. Emphasize the importance of correct documentation for audit preparedness.

12: Self-Employed Health Insurance Deduction Worksheet

Navigate the Self-Employed Health Insurance Deduction Worksheet with a focus on list coverage charges and different eligible clinical and dental costs. Understand the particular concerns for self-hired taxpayers, consisting of the absence of the 7.5% AGI dilemma for coverage premiums. Ensure meticulous documentation for an accurate deduction calculation.

Sources

“5 Medical Deductions (you didn’t know you could take)” – The Tax Geek

For additional details, refer to IRS Publication 502, which covers Medical and Dental Expenses.

Conclusion: Empower Yourself with Knowledge for Maximum Tax Benefits

Armed with a complete information of the medical fee deduction, coverage rates, and related tax blessings, you may navigate tax season with confidence. Whether you’re maximizing deductions for clinical or dental charges, exploring the HCTC, or unraveling the complexities of based care credit, this manual equips you with the expertise to optimize your tax financial savings. Stay informed, stay prepared, and make the maximum of the possibilities to be had to you.