The annual tax filing ritual can feel like navigating a complex maze, and 2024 presents some unique twists and turns for taxpayers. The IRS, still grappling with the after-effects of the pandemic and an ever-evolving tax landscape, faces challenges that may impact your filing experience. But fear not, intrepid tax adventurer! By understanding these hurdles and implementing some strategic tips, you can emerge from the maze victorious (and hopefully with a nice refund).

1: Staffing Shortages and Processing Delays

The IRS continues to battle staffing shortages, which could lead to longer processing instances for returns and irritating smartphone wait times. To fight this, embody the digital age! File electronically each time possible. Electronic submitting is not handiest quicker and more accurate, however it additionally creates a clean digital report for each you and the IRS. Additionally, leverage the wealth of facts to be had on the IRS website (https://www.Irs.Gov/). There you could find answers to regularly requested questions, get admission to assets and tools, or even manage your tax account on line.

Tip: Don’t wait till the remaining minute to file! Submit your go back electronically well before the deadline to avoid any ultimate-minute hiccups as a result of processing delays.

2: Ever-Changing Tax Laws

Keeping up with the ever-evolving tax code can experience like chasing a shifting target. This yr is no distinct. New rules or updates to present policies can considerably effect your tax go back. Don’t wander away in the legalese! Consult reliable sources like the IRS website or publications or keep in mind looking for the help of a certified tax professional to ensure you are claiming all of the deductions and credit you deserve.

Tip: Bookmark the IRS “Tax Topics” page (https://www.irs.gov/help/tax-topics) on your browser for easy access to up-to-date information and guidance on a variety of tax-related topics.

3: Limitations on In-Person Services

Due to ongoing health worries, in-character services at IRS places of work can also remain constrained. While the benefit of face-to-face interactions is probably neglected, the IRS gives a sturdy suite of online services. You can manipulate your tax account, view your charge records, make bills, and access various forms and sources all from the consolation of your own home.

Tip: Get familiar with the IRS online portal. Explore what offerings are supplied and how to navigate the system.

4: Heightened Cybersecurity Threats

The IRS, by means of virtue of the sensitive records it handles, is a top target for cybercriminals. Be on high alert for phishing scams designed to scouse borrow your non-public information or get right of entry to your tax account. Remember, the IRS will in no way initiate contact through email or telephone inquiring for touchy statistics like your Social Security quantity or financial institution account details.

Tip: Only access your IRS account through the official IRS website (https://www.irs.gov/). When in doubt, don’t click on suspicious links or attachments in emails supposedly from the IRS.

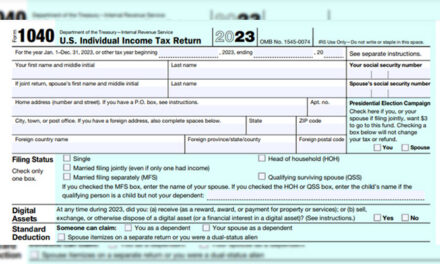

5: The Rise of Virtual Currency

The growing reputation of cryptocurrency like Bitcoin and Ethereum has brought new complexities for the IRS. Reporting and taxation of cryptocurrency may be intricate, and the policies are still evolving. If you dabbled in cryptocurrency transactions in 2023, recall enlisting the assist of a tax professional acquainted with virtual property.

Tip: Keep meticulous data of all of your cryptocurrency transactions, including purchase dates, quantities, and sale fees. This will make correct reporting in your tax go back an awful lot easier.

6: Foreign Tax Issues for Expats

U.S. Citizens dwelling abroad face extra complexities in terms of submitting taxes. Regulations can range substantially from those applicable to home taxpayers. If you call a foreign USA domestic, be sure to investigate your precise situation and consult with a tax expert who makes a speciality of worldwide tax matters.

Tip: The IRS offers resources specifically tailored to U.S. citizens residing abroad. Visit the “Publication 54, Tax Guide for U.S. Citizens and Resident Aliens Abroad” page (https://www.irs.gov/pub/irs-pdf/p54.pdf) for more information.

7. Increased Scrutiny for High Earners

The IRS might be devoting more resources to scrutinizing the tax returns of high-income earners. This doesn’t necessarily mean you’ll be audited, but it does emphasize the importance of accuracy and documentation. Ensure all your income is meticulously reported and that you have proper documentation to support any deductions or credits you claim.

Tip: Maintain a well-organized filing system for all your tax-related documents like receipts, invoices, and W-2 forms. This will save you time and hassle if your return is selected for further examination.

8: Potential for Tax Law Changes

Tax laws are not set in stone, and 2024 could see further legislative changes. Stay informed! Regularly check the IRS website or subscribe to reputable tax news sources to keep abreast of any potential updates that could affect your tax return.

Tip: Consider signing up for email alerts from the IRS to receive notifications about any new tax laws or regulations.

9: Delayed Refunds

The aforementioned staffing shortages and processing delays might also translate to longer wait times for your tax refund. There are ways to expedite the process, however. Filing electronically and submitting all required documentation with your return can significantly speed things up.

Tip: If you are expecting a significant refund, consider opting for direct deposit into your bank account instead of waiting for a paper check to arrive in the mail.

10: The Persistent Threat of Identity Theft

Tax-related identity theft remains a serious concern. Criminals can use stolen personal information, like your Social Security number, to file fraudulent tax returns and claim your refund. Here are some crucial steps to take to protect yourself:

- Be cautious about sharing your personal information. Don’t readily share your Social Security number or other sensitive information unless you are absolutely certain who you are dealing with.

- Monitor your credit report regularly. Look for any suspicious activity that might indicate identity theft. You can access free credit reports from each of the three major credit reporting bureaus (Equifax, Experian, and TransUnion) once a year at https://www.annualcreditreport.com/index.action.

- File your tax return early. This reduces the window of opportunity for criminals to file a fraudulent return in your name.

- Report any suspected identity theft to the IRS immediately. The IRS Identity Theft Information webpage (https://www.irs.gov/identity-theft-central) provides resources and instructions on how to report identity theft and protect yourself.

By expertise those top 10 IRS challenges for 2024 and imposing the endorsed guidelines, you could navigate the tax filing maze with self assurance. Remember, the IRS offers a wealth of records and resources to assist taxpayers. Don’t hesitate to utilize their website, consult a tax professional for steerage, and take proactive steps to guard yourself from fraud. With a bit instruction and cognizance, you could make certain a smooth and a hit tax filing season.