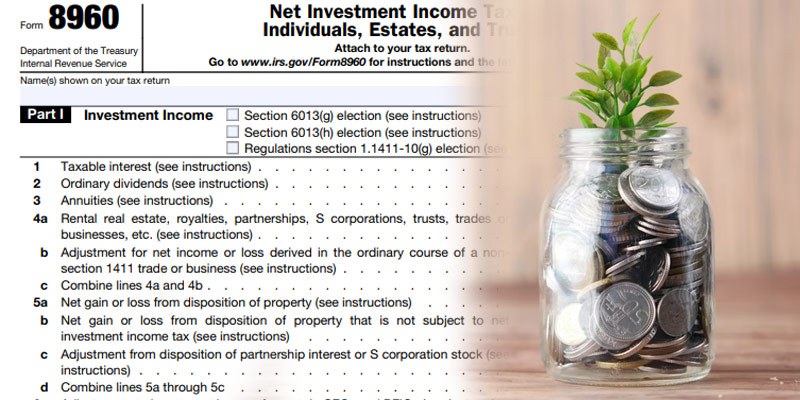

IRS Form 8960, called the Net Investment Income Tax (NIIT) Individuals, Estates, and Trusts, serves as a critical device in figuring out and reporting the Net Investment Income Tax legal responsibility. This tax, distinct from normal income taxes, applies to people, estates, and trusts, targeting precise funding earnings assets. Understanding Form 8960 is paramount for complying with tax obligations successfully.

Understanding the Net Investment Income Tax (NIIT)

The Net Investment Income Tax (NIIT) is a supplemental tax introduced to support the Affordable Care Act. It is levied on unique funding profits and applies to people, estates, and trusts. Unlike traditional income taxes, NIIT focuses on profits generated from investments in place of earned income.

Who Needs to Use Form 8960?

Form 8960 is mandatory for individuals, estates, and trusts that exceed specific online income limits. For individuals, this obligation arises if their filing meets certain criteria, including single filing couples with an income of $125,000, single or heads of households with benefits in excess of $200,000, or married couples with combined incomes in excess of $250,000 filing. Form 8960 is excluded from the filing by failure to comply with these restrictions.

Components of Form 8960

Gathering Investment Income: The initial step in finishing Form 8960 involves compiling diverse funding income resources. This encompasses profits from dividends, interest, capital profits, rental profits, and certain passive activities. Accurate reporting of those profits streams is vital for calculating NIIT legal responsibility effectively.

Deductible Investment Expenses: Form 8960 lets in for deductions related to investment fees. These may also include funding hobby fees and expenses associated with apartment activities. Proper documentation assisting those deductions is essential to ensure compliance and limit tax liability.

Tax Computation: The final segment of Form 8960 entails computing the real tax owed. This involves comparing Modified Adjusted Gross Income (MAGI) towards special threshold amounts to decide NIIT legal responsibility correctly. It is vital to adhere to the modern commands supplied with Form 8960 to make sure compliance with tax rules.

Conclusion

In end, Form 8960 plays a pivotal role in determining and reporting the Net Investment Income Tax (NIIT) liability for individuals, estates, and trusts. By understanding the intricacies of this form and following the prescribed suggestions, taxpayers can satisfy their duties accurately and successfully. Compliance with tax rules is crucial to keep away from consequences and make sure financial stability. Therefore, it’s far really useful to searching for expert help while navigating complicated tax matters to make certain compliance and reduce tax legal responsibility.

References:

“IRS Form 8960 walkthrough (Net Investment Income Tax for Individuals, Estates, & Trusts)” – Forrest Baumhover, Certified Financial Planner and tax practitioner at Teach Me! Personal Finance.

I loved as much as you will receive carried out right here The sketch is attractive your authored material stylish nonetheless you command get got an impatience over that you wish be delivering the following unwell unquestionably come more formerly again since exactly the same nearly a lot often inside case you shield this hike.

I genuinely enjoyed the work you’ve put in here. The outline is refined, your written content stylish, yet you appear to have obtained some apprehension regarding what you wish to deliver thereafter. Assuredly, I will return more frequently, akin to I have almost constantly, provided you maintain this climb.

I truly appreciated the work you’ve put forth here. The sketch is tasteful, your authored material stylish, yet you appear to have developed some nervousness regarding what you intend to deliver next. Rest assured, I’ll return more regularly, much like I’ve done almost constantly, should you maintain this upward trajectory.

This website is an absolute gem! The content is incredibly well-researched, engaging, and valuable. I particularly enjoyed the [specific section] which provided unique insights I haven’t found elsewhere. Keep up the amazing work!