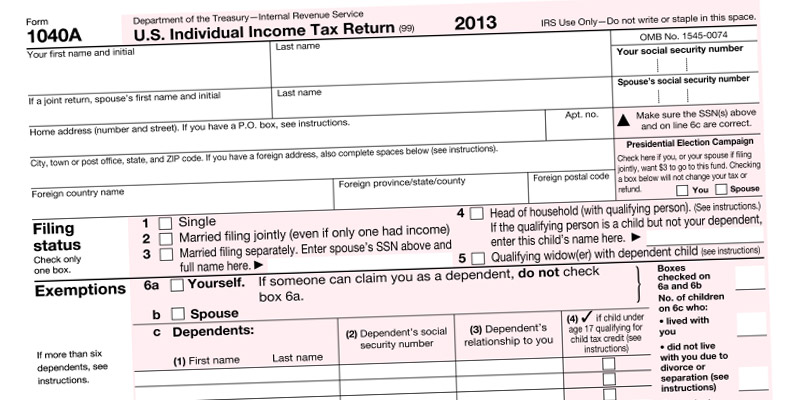

IRS Tax Form 1040A, often called “the short form,” is an easier way for people to report their income and figure out their taxes. It’s like a shorter version of the more complicated IRS Tax Form 1040 and covers more situations than the really simple 1040EZ.

Using Form 1040A can save time compared to Form 1040, and the IRS tends to process it faster. Anyone, no matter their age or filing status, can use this form, and it’s due by April 15th. While many people can use Form 1040A, it’s good to check out Form 1040 too, just in case it offers more options.

To use IRS Tax Form 1040A, you need to meet these conditions:

- Income Below $100,000:

- Your income should be less than $100,000.

- Income from Specific Sources:

- Your money should come from specific places like wages, salaries, tips, interest, and other common sources.

- Limited Adjustments to Income:

- You can only make certain adjustments, like teacher expenses, IRA deductions, student loan interest, and tuition/fees deductions.

- No Itemized Deductions:

- You can’t choose to itemize your deductions.

- Specific Tax Credits:

- You can only claim specific tax credits, like child tax credit, earned income tax credit, and others.

- No Alternative Minimum Tax (AMT) Adjustment:

- You shouldn’t have to deal with Alternative Minimum Tax (AMT) stuff.

You can also use Form 1040A if you got advance Earned Income Credit (EITC) payments, dependent care benefits, or if you owe tax because of an education credit or the AMT.

Before starting with IRS Tax Form 1040A, make sure you have:

- ID and residency info

- Social Security Numbers for you, your spouse, and dependents

- Birthdates for everyone

- A copy of your last tax return

- Statements of your earnings (like W-2s, 1099s)

- Info on any tax credits or deductions you qualify for

- Bank account details for Direct Deposit

You can get Form 1040A online, or pick it up at places like post offices, libraries, tax centers, or IRS offices. If you prefer, you can ask for it to be mailed to you.

In summary, IRS Tax Form 1040A is a simpler way to do your taxes if you meet the conditions. Just gather the right info and choose the form that works best for you. Forms 1040A and 1040EZ are no longer available. Taxpayers who used one of these forms in the past will now file Form 1040. !