When it involves managing investments, in particular in regulated investment businesses (RICs) like mutual funds, actual property funding trusts (REITs), and other investment motors, it’s essential to be aware about the results of undistributed long-time period capital gains. This article explores the importance of IRS Form 2439, losing mild on its purpose, how undistributed profits are taxed, and the benefits of submitting this form.

Unveiling Undistributed Long-Term Capital Gains

Undistributed lengthy-time period capital profits occur when a fund or employer keeps profits generated from the sale of investments held for multiple 12 months, in place of distributing them to shareholders. This approach permits the fund to reinvest the gains, potentially increasing the fund’s common cost. However, it is vital for shareholders to be informed approximately those undistributed profits, although they have not acquired them without delay.

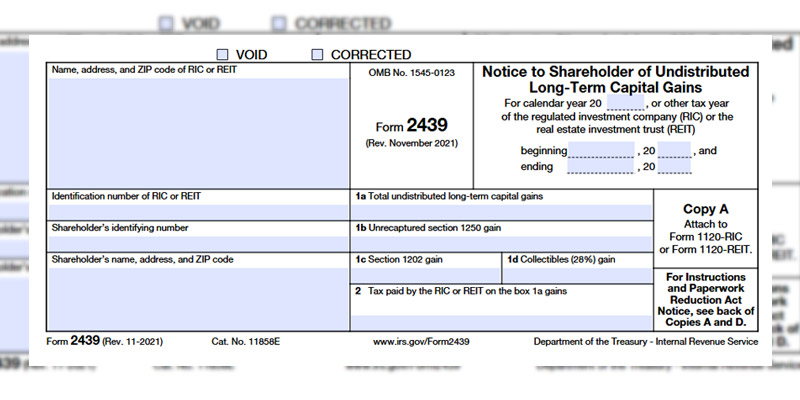

The Role of Form 2439

Form 2439 is a tax record mandated for filing by using positive investment businesses, mutual price range, and REITs. This shape notifies shareholders approximately undistributed lengthy-time period capital gains and offers critical info for correct reporting on their tax returns. Shareholders might also acquire a tax credit for the taxes paid by means of the fund corporation on these profits, enhancing transparency among traders and the fund.

Taxation of Undistributed Long-Term Capital Gains

Unlike other kinds of income, undistributed lengthy-time period capital gains aren’t straight away taxed at the investor level. Instead, the fund agency can pay a tax without delay on those gains. This particular taxation method ensures that RICs and REITs distribute the majority in their funding profits to shareholders. Form 2439 serves as a means to meet this requirement even as notifying shareholders about undistributed profits.

Benefits of Filing IRS Form 2439

One of the substantial benefits of filing Form 2439 is the possibility for shareholders to claim a credit score for taxes paid by the mutual fund on undistributed long-time period capital profits. By accurately reporting this data on their tax returns, traders ensure compliance with IRS policies and hold transparency with the fund. Additionally, filing Form 2439 lets in the fund to distribute its taxable earnings to shareholders, aligning with IRS rules.

Applicability to Various Investment Vehicles

Form 2439 is specifically required for shareholders of regulated investment agencies while capital gains distribution occurs. This consists of mutual finances, change-traded price range, REITs, and unit investment trusts. Whether you are invested in actively-managed price range or different RICs, submitting Form 2439 is important for correctly reporting earnings and selling transparency between traders and the fund.

Sources

“IRS Form 2439 – How to Report on Form 1040” by Jason D. Knott

Conclusion:

In conclusion, understanding IRS Form 2439 is vital for traders in regulated funding organizations. This form plays a critical function in notifying shareholders approximately undistributed long-term capital profits, facilitating accurate reporting on tax returns, and presenting an possibility to claim a credit for taxes paid by using the fund. By comprehending the results of undistributed gains and the significance of submitting Form 2439, buyers can navigate the complex panorama of taxation inside the world of investments.